"Obsess over competitors, but focus on customers."

- Jeffrey Bezos

Competition is heating up in the SaaS industry. With thousands of new SaaS companies launching every year, customer acquisition is becoming more and more challenging. As a SaaS founder or marketer, you need to closely monitor your competitors' marketing strategies and spending to stay ahead of the curve.

In this essay, I'll explain why paying attention to your competitors' marketing spend is critical, how to track it, and how to leverage those insights to improve your own SaaS marketing.

Why Your Competitors' Marketing Spend Matters

There are several reasons why you need to pay attention to what your competitors are spending on marketing:

It gives you an unfair advantage

Knowing where your competitors are investing their marketing dollars allows you to find gaps in the market. If you see they are spending aggressively on SEM and neglecting content, you can double down on content and own that channel. These insights give you opportunities to outflank and outmaneuver the competition.

It keeps you from overspending

If you operate in a vacuum, you may end up overspending on marketing tactics that provide diminishing returns. But if you see that your competitors have already saturated certain channels, you can avoid wasting budget and focus your dollars on more high ROI areas.

It helps you set benchmarks

Understanding your competitors' CAC and marketing spend helps you set benchmarks and goals for your own SaaS company. You can aim to beat their cost-per-lead or match their spending in key channels as percentage of revenue. This competitive intelligence allows you to evaluate your own marketing performance.

It alerts you to new threats

If you suddenly notice one of your competitors doubling or tripling spend on a new channel, that's a clear signal they are making a major marketing push. You need to find out why, whether you're missing something, and how to respond. Monitor rising competitors closely.

How to Track Your Competitors' Marketing Spend

Now that you know why it's important, here are some tips on how to track your competitors' marketing spend:

Use spy tools

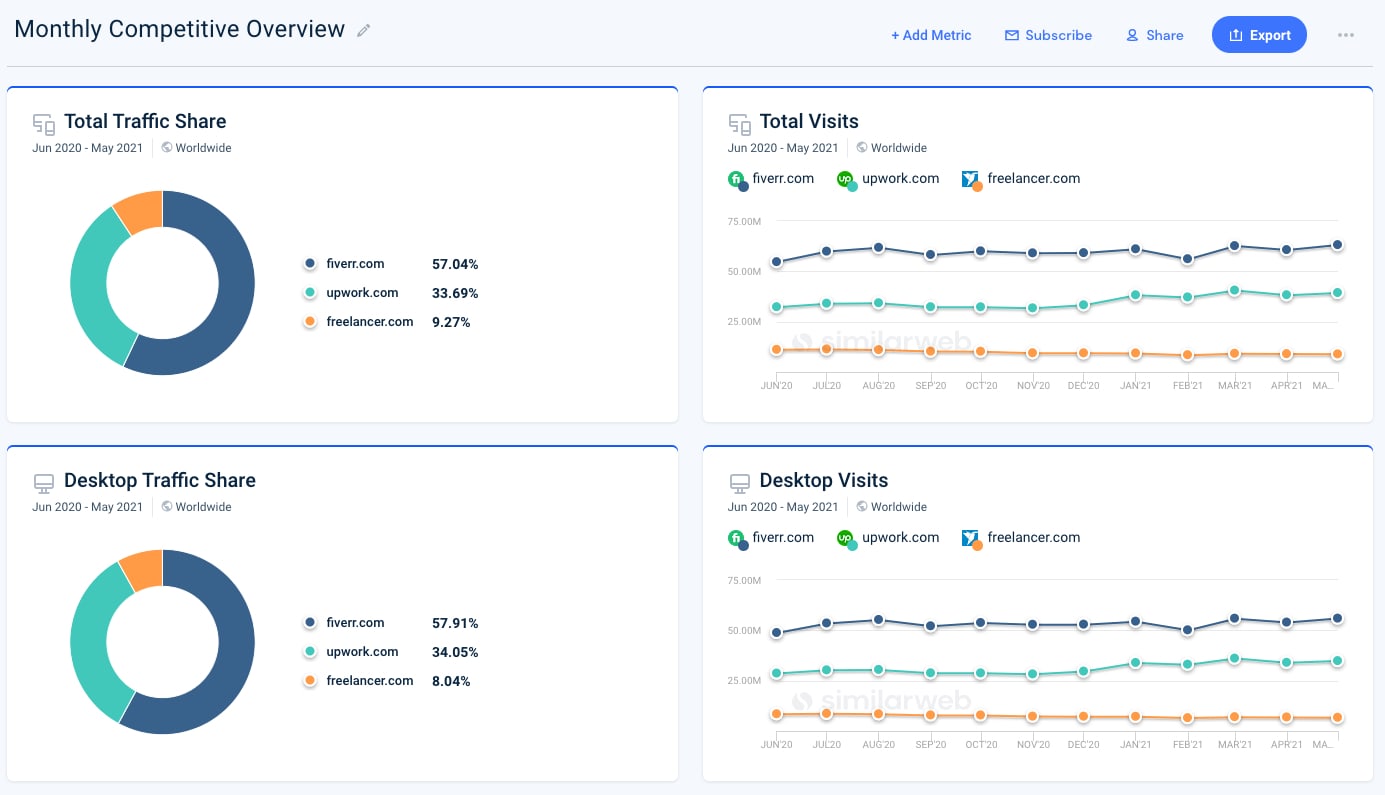

Services like SimilarWeb, Ahrefs, and SEMRush provide detailed competitive intelligence on the digital marketing activities of other companies. You can see their paid traffic, search volume, display ads, and more. These tools give you macro-level insights across all marketing channels.

Monitor their job postings

Head to LinkedIn and keep an eye on new roles your competitors are hiring for. If you notice they are aggressively expanding their SEO team or looking for more paid social experts, that indicates where they are investing. Job listings give you a glimpse into their strategy.

Analyze their content output

Use tools like BuzzSumo to analyze what content your competitors are publishing, how often, and on which channels. Massive increases in blogging or video output could signal a growth in spend. Study their content strategy for clues.

Check their social ad spending

Hop on Facebook Ads Library and Google Ads Transparency reports. Enter your competitors' domains to estimate their spending on social/search ads. See if it's rising or falling over time. This reveals their paid marketing budget.

Talk to shared vendors

Chat with your PR agency, web development firm, etc and casually ask what other clients they are working with. Sometimes you can get unofficial intel on competitors' plans or budgets from shared marketing vendors. But tread carefully.

Sign up for their services

One sneaky but effective tactic is to actually become a customer. Subscribe to their newsletter, create a trial account, and walk through their onboarding flows. This gives you valuable intel on their marketing and product from the inside.

Attend industry events

Keep an ear out for announcements or chatter about your competitors at industry conferences and networking events. Sometimes you can pick up gossip on big initiatives at competitors that aren't public yet. Take these rumors with a grain of salt.

What To Do With Competitive Intelligence

Once you've done the work to gather intel on your competitors' marketing and ad spend, here are some ideas on how to actually make use of it:

- Find gaps. Look for areas where competitors are underinvesting that you can double down on, like content, influencer, or lifecycle marketing.

- Get creative. If they are blanketing a channel like Facebook ads, get ingenious with lesser-used platforms like Quora or TikTok.

- Improve targeting. See who they are reaching with display ads and use similar targeting parameters in your campaigns.

- Shift budget. Increase or decrease your budget based on if competitors are aggressively spending or pulling back in certain channels.

- Test new vendors. If competitors are using a vendor that's working well, research them and consider testing it out too.

- Leverage their content. Check out high-performing competitor content and make your own version with a unique spin.

- Build alerts. Get notified if competitors launch new products or initiatives, so you can rapidly respond.

- Validate assumptions. See if areas you've deprioritized are actually high-growth channels worth revisiting based on competitors' spend.

- Forecast trends. Spikes in competitors' spending signals where the market is heading next. Start testing channels before they get too crowded.

- Sell against them. Use competitors' high prices, lack of features, or weak marketing as fodder when selling to prospects.

The key is to not just passively monitor competitors' spend, but act on the intelligence. Match their initiatives in channels working well, and zig where they zag. This competitive analysis gives you a serious edge.

Common Counterarguments

However, some may argue competitive intelligence is a waste of time:

"Just focus on your own strategy, not competitors"

While it's true you shouldn't let competitors dictate your strategy, ignoring them altogether is equally unwise. The competition provides extremely useful benchmarking for your performance on key SaaS metrics.

"Our product is so superior, we don't need to worry about competitors"

Having the best product isn't enough. Competitors with inferior products can gain advantage through marketing, pricing, partnerships and more. Assume competitors are competent and don't underestimate them.

"We're too early stage, it's too soon to think about competitors"

It's never too early. Start gathering competitive intelligence on day one. Early monitoring helps you spot new market entrants before they become big threats. You have more time to adapt your strategy.

"Our market has near-infinite TAM, so competitors are irrelevant"

Even in massive markets, competitors make growth much harder. Without benchmarking against them, you operate in a vacuum. Use competitors to pressure-test your product strategy and marketing ROI.

"We want to innovate, not copy competitors"

Smart competitive intelligence doesn't mean copying competitors. It means using their moves to find strategic openings. You can still innovate once you know where competitors are over-invested or neglecting.

Key Takeaways

Here are the core lessons on why monitoring your SaaS competitors' marketing spend matters:

- Closely tracking competitors' spend provides an unfair competitive advantage if you react appropriately.

- It keeps you from overspending by revealing the saturation of marketing channels.

- You can set more accurate benchmarks and goals based on competitors' performance.

- Watch for shifts that indicate threats like new channel investment or product launches.

- Use spying tools and conversations to estimate competitors' overall marketing budgets.

- Turn insights into specific strategic actions - find gaps, get creative, shift budget, sell against them.

- Even with the best product and massive market, competitors must be monitored and responded to.

Ignore your competitors and operate in a vacuum at your own peril. Use competitive intelligence to make informed strategic decisions, spot threats early, and sustain an advantage. With so much on the line, you need to obsess over what your competitors are doing and how they are spending their marketing dollars.

FAQ

1. Why should I track my competitors' marketing spend if I'm more focused on my own customers?

Knowing where your competitors invest provides an unfair advantage. You can find gaps in underserved channels and spot oversaturated areas to avoid. Competitors also help benchmark your CAC and ROI. Even with the best product-market fit, you need to monitor your competition.

2. What are the best tools for tracking competitors' digital marketing activity?

- SimilarWeb - Provides estimates of competitors' traffic sources, social engagement, display ads.

- SEMrush - Tracks competitors' organic and paid search efforts.

- BuzzSumo - Analyze competitors' content performance and outreach.

- Facebook Ad Library - View competitors' Facebook ad creatives, spend, targeting.

3. How can I estimate my competitors' marketing budgets or team size?

- Study their hiring listings on LinkedIn to tally openings like "SEM Manager" or "Content Specialist".

- Use SimilarWeb and BuzzSumo to estimate traffic and content volume which hints at size of marketing team.

- Ask questions subtly on anonymous forums or conferences.

- Make reasonable estimates based on their revenue and growth stage.

4. What should I do if I notice a competitor rapidly increasing spending on a new channel?

- Immediately start testing that channel in a small way to match them.

- Analyze any new campaign creatives they are running for clues.

- Have a team brainstorm on ideas for differentiated creative in that channel.

- Talk to vendor partners knowledgeable on that channel for intel.

5. How often should I review competitors' marketing activity and spending?

Ideally, you should have a weekly or bi-weekly standing competitor update meeting or shared report. Key stakeholders from marketing, product, and sales should attend to strategize responses. Also set news alerts on key competitors for real-time monitoring.

6. What are signs we may be overspending on marketing compared to competitors?

- Higher CAC or lower ROAS than competitors benchmarks.

- Poor performance in channels competitors have eased back on.

- Not gaining share of voice/traffic in saturated channels.

- Competitors pivoting spending to new untested channels.

7. If my product is superior, do I still need to worry about competitors' marketing?

Absolutely. Even far inferior competitors can gain advantage through effective messaging, creative content, pricing, or leveraging new ad platforms. Never underestimate competitors' marketing prowess. Great products don't sell themselves.

8. How can I use competitors' marketing gaps to my advantage?

If competitors are underinvesting in areas like referrals, lifecycle email, or niche communities - double down there. Avoid copying competitors' existing strategies. Instead find areas they are neglecting and own them.

9. Isn't competitive intelligence unethical? How do I avoid shady tactics?

Never hack, deceive, or engage in industrial espionage. But using public information and vendor intel ethically is fair game. Talk to partners, not disgruntled employees. Draw conclusions rationally, not conspiratorially.

10. How can I encourage my team to prioritize tracking competitors?

- Make it a KPI for marketing managers.

- Start meetings by sharing a competitor insight.

- Gamify it with small rewards for key intel.

- Tie compensation to beating competitors' benchmark metrics.

- Celebrate wins when your creative tactics outflank competitors.

Make competitor intelligence a cultural value, not just a one-off exercise. Foster healthy paranoia, but focus efforts on your customers and product. Monitoring competitors should inspire creativity, not paranoia.