Competitive intelligence isn't just about knowing your rivals; it's about understanding the playing field better than they understand it themselves. This means going deeper than surface-level analyses. To uncover the strategies, weaknesses, and hidden opportunities others miss, you need the right tools.

I get it: Building a tech stack is never simple. Particularly within competitive intelligence, there's a sea of shiny options promising you insights. But how do you know where to start?

That's where this post comes in. I'll help streamline the process, guiding you on the key categories of tools to consider and specific examples to put this guidance into context.

Foundation: Defining Your Competitive Intelligence Goals

Don't just build a tech stack for the sake of it. Start with a clear purpose:

Product Development: Are you looking to identify features your competitors are lacking, or whitespace in the market for innovation?

Marketing & Sales: Do you want to understand how your competitors position themselves, their messaging, or how they win deals?

Company-Level Insights: Interested in tracking competitor funding, partnerships, leadership changes, or potential acquisition targets?

These goals will drive your tech stack choices.

The Essential Competitive Intelligence Tech Stack

Let’s talk about the 'must-haves' in your CI tech stack. There might be some overlap with the tools your marketing team is already using, but here we get hyper-focused on extracting competitive insight from them.

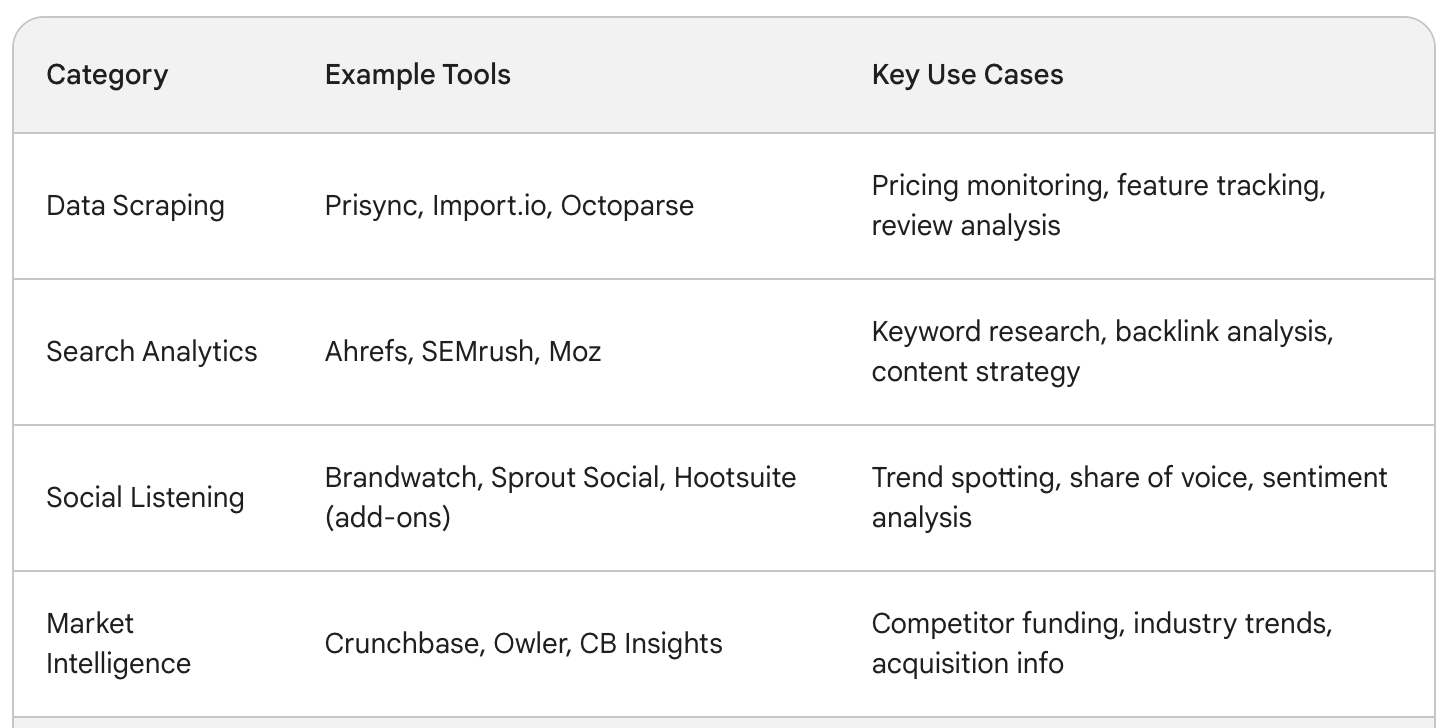

1. Data Scraping

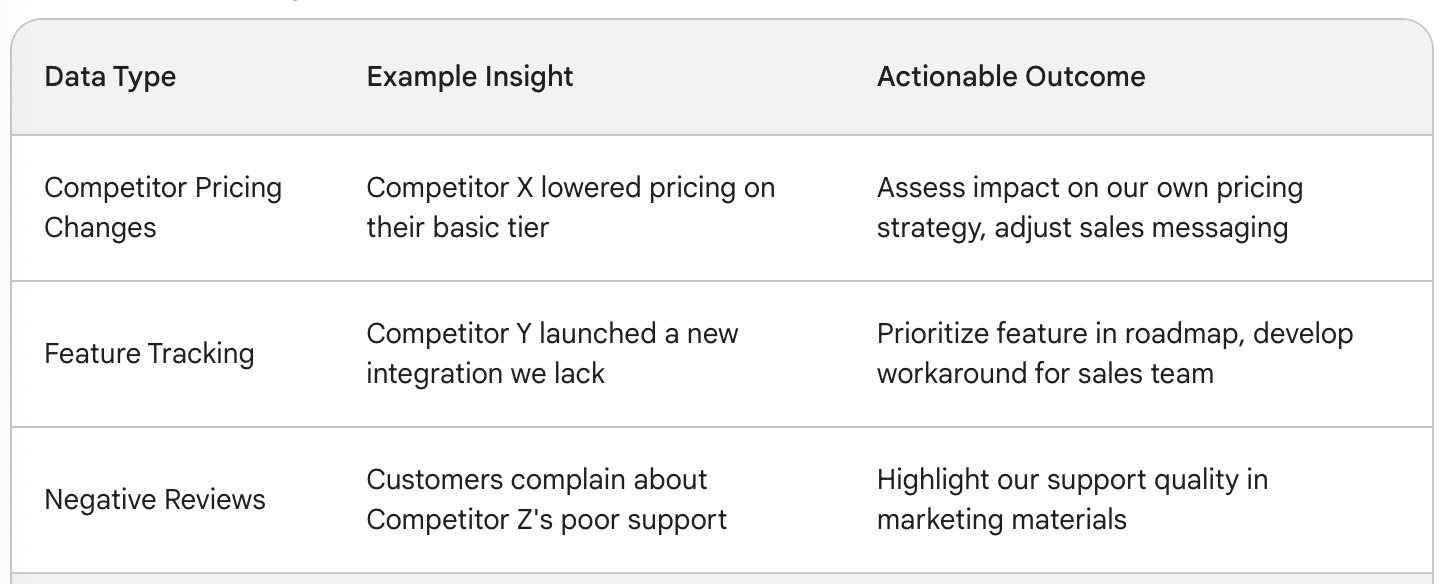

Gathering competitor data directly from websites, reviews, or other online sources is essential. Web scraping tools streamline this massively. Here are a few different use cases:

Pricing Monitoring: Track how your competitors' price points change over time for tactical decision-making. Consider tools like Prisync or Import.io.

Feature Tracking: Build a matrix of your features vs. competitor features. Many scraping tools can parse tables readily available on competitor websites to do this effortlessly.

Online Reviews: Stay on top of what customers are saying about your competitors. Track sentiment and identify pain points to exploit in your messaging. Tools like Octoparse excel at this.

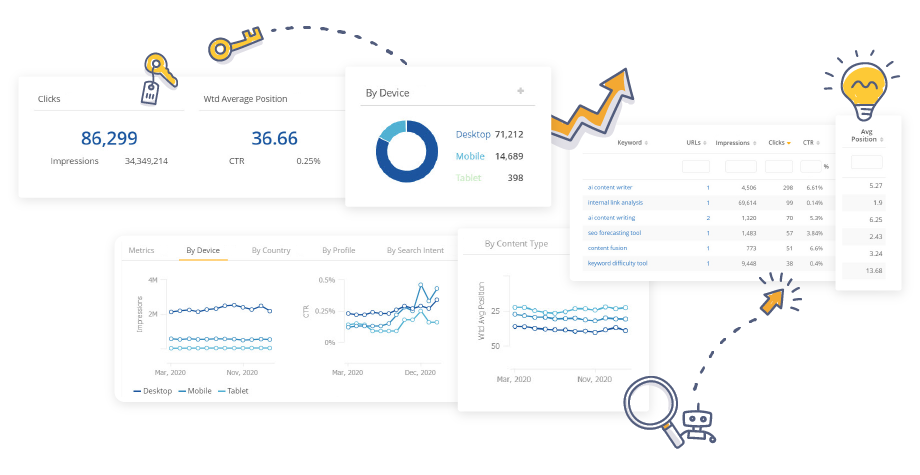

2. Search Monitoring and Analytics

Search engines offer a vast repository of competitor intel if you know how to uncover it. You need to go beyond just a few Google searches.

SEO Analysis: Track competitor rankings for target keywords, backlinks, content strategy, and domain strength. This is where tools like Ahrefs, SEMrush, or Moz come in strong.

Brand Mentions: Set up alerts not just for your own brand but for competitor brands to uncover conversations and brand perception. Google Alerts is basic but free; Mention is more sophisticated.

Competitive Paid Ad Analysis: Unpack your rivals' paid strategies. See what keywords they bid on, what their ad copy is, and where ads are placed. Again, SEMrush or tools like SpyFu are powerhouses here.

3. Social Listening

Social media holds a goldmine of raw customer sentiment—not just about you, but about your competitors too. Effective listening tools help you:

Trendspotting: Identify trending topics and discussions within your industry that competitors are tapping into (or missing!)

Customer Pain Points: Get real-time feedback on competitor products and compare that against your own offering.

Share of Voice Analysis: Understand your market share compared to competitors based on social mentions and engagement.

Social listening can be as simple as setting up advanced searches on native platforms or using dedicated tools like Brandwatch, Sprout Social or even Hootsuite with the right add-ons.

4. Company Data & Market Intelligence Platforms

For deeper analysis on companies—be it your rivals or the industry in general—you'll need dedicated platforms. These aggregate news, public filings, financial reports, and more:

Crunchbase: Great for tracking competitor funding, leadership, and potential acquisition targets or partnerships.

Owler: Another useful company intelligence source, especially for finding detailed revenue estimates.

CB Insights: If you want industry-level data, trends, venture deals, and more, this is a powerhouse (though be prepared for a hefty investment).

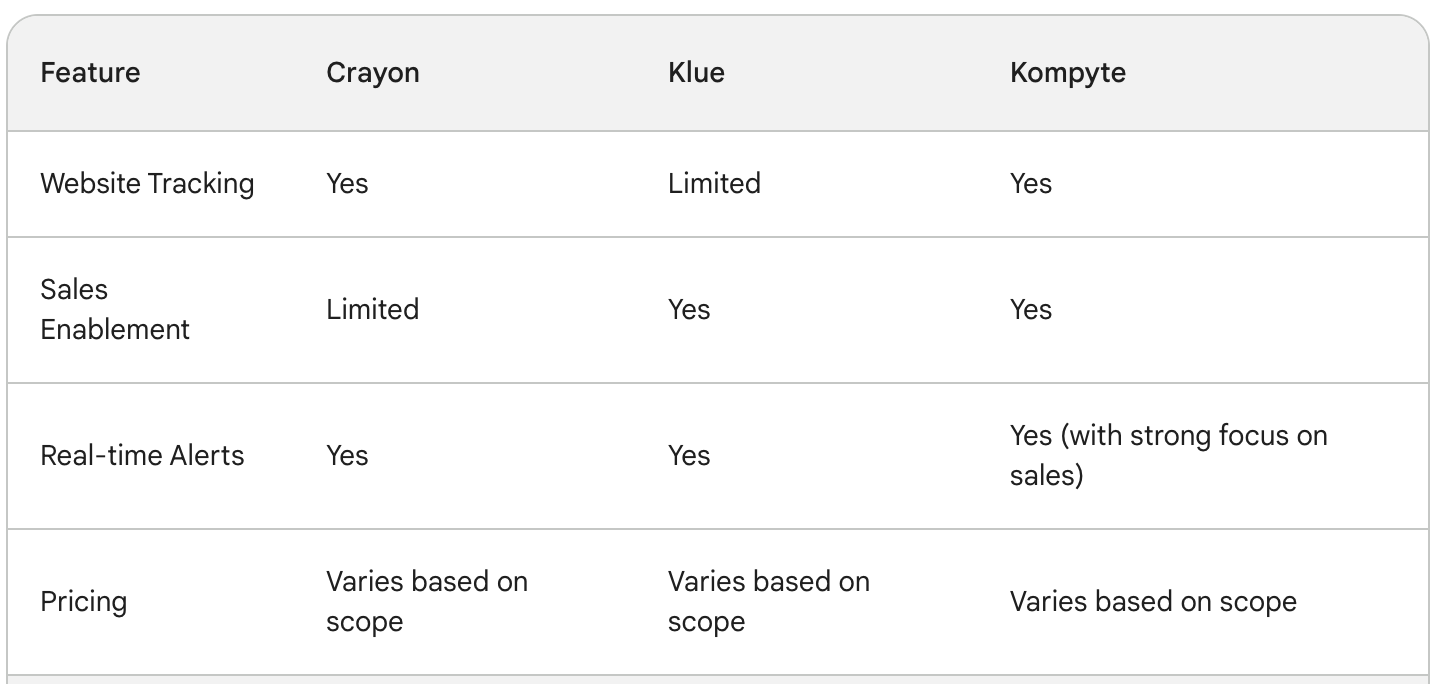

Specialized Competitive Intelligence Tools

When you're ready to advance beyond the basics, consider niche CI platforms. These offer a depth of analysis and features that are tailored specifically to unearthing complex insights.

Crayon: One of the leaders in the CI space, Crayon tracks competitor websites, marketing materials, social activity, and more. Its strength lies in its ability to surface changes and patterns over time, providing a dynamic view of competitor movements.

Klue: Designed for sales and marketing enablement, Klue helps you create battlecards, centralize competitive data, and track win/loss scenarios for better-informed responses to competitors.

Kompyte: If you find yourself battling competitors head-to-head on deals, Kompyte arms you by monitoring competitor demos, sales pitches, pricing changes, etc., in real time.

The Secret Sauce: Process & Integration

Tech alone won't move the needle – you also need an iron-clad process for your CI efforts. Consider these key elements:

Data Centralization: Competitive insights won't help if they're fragmented. Choose a central repository: It could be a shared doc, a CRM field, or a dedicated CI platform with access controls.

Insight Distribution: How will you get insights in front of teams that require them? Sales battlecards? Slack updates? Email newsletters? Think strategically about dissemination.

Cadence for Analysis: Competitive monitoring should be ongoing, not sporadic. Build regular time into your team's schedule to analyze data and uncover trends.

Additionally, a crucial piece of the puzzle is integrating your CI toolset within your existing marketing stack. Can you feed competitive ad spend data from SEMrush directly into your marketing analytics dashboard? Can website changes flagged by Crayon trigger a Zapier workflow to populate a battlecard? These integrations save time and make your CI data actionable.

The Human Element – CI is Not Automated!

Even the most sophisticated tech stack is only as good as the analysts and strategists using it. Competitive intelligence is fundamentally about interpretation, something even the best AI is still learning to do. This means training your team in critical thinking, pattern recognition, and connecting the dots between disparate data points.

Here are some ways to cultivate a competitive analysis mindset in your organization:

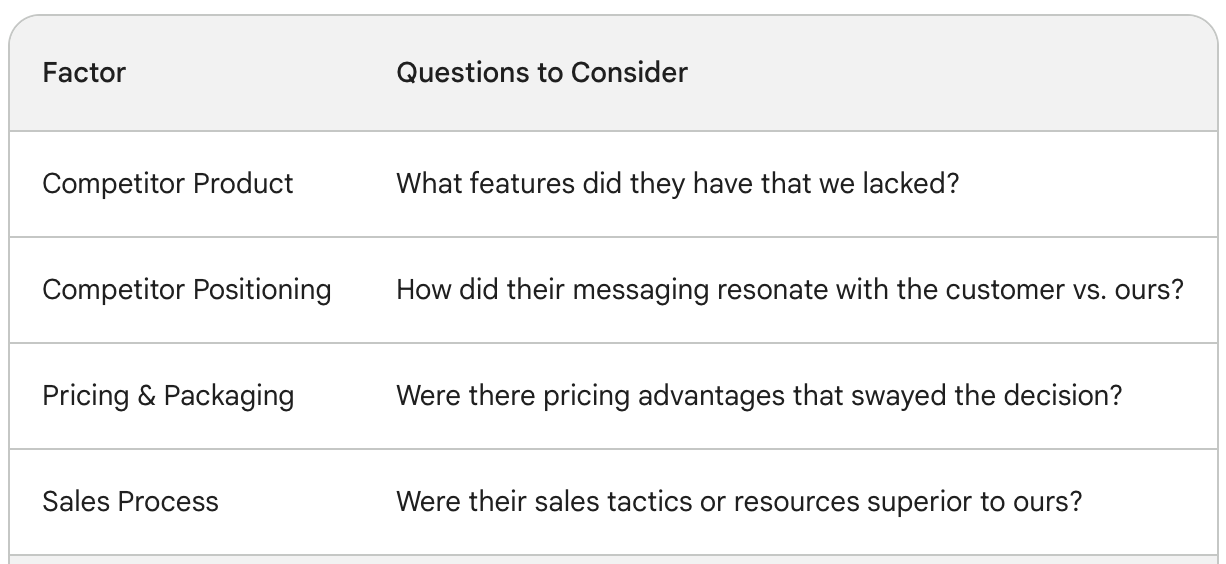

“Win/Loss” Deep Dives: When you win or lose a deal, go beyond the surface reasons. Dig into what your competitor had that you didn't, or where they faltered.

“War Gaming”: Role-play scenarios where your competitor releases a new feature, changes pricing, or launches a smear campaign. How would your team respond? This builds strategic muscle memory.

External Collaborators: Tap into your network of industry analysts, ex-employees of competitors, or engaged customers. External perspectives can offer a fresh lens.

Important Caveats

Before you go all-in on building this CI empire, a few notes of caution:

Ethical Considerations: Competitive intelligence is not industrial espionage. Avoid tactics that cross into 'stealing' trade secrets or violating privacy.

Data Overload: Having too much data can be as useless as having none. Focus on the insights that are truly actionable, not just 'interesting'.

ROI Justification: CI tech stacks can be expensive. Be prepared to demonstrate the value gained and the ROI, especially to leadership.

Competitive Intelligence is an Investment, Not a Checkbox

Building a robust CI tech stack and a process around it takes time and resources. But the payoff is immense. By outsmarting your competition, you gain a strategic edge in product development, marketing, sales, and company-level decision-making. It's the kind of investment that separates the winners from the rest of the pack.

FAQ

1. I'm new to competitive intelligence. Where should I begin?

Start small. Don't attempt to build the entire tech stack at once. First, identify your most pressing competitive questions (Are they about product gaps? Pricing strategies? Marketing messaging?). Choose one or two areas to focus on and select tools designed for the task.

2. Can't I just do all this research manually?

Technically, yes, but CI tools save immense time and uncover patterns you might miss. Web scraping automates data collection. SEO tools reveal competitor backlink strategies that would take weeks to piece together manually. Social listening at scale is practically impossible without dedicated software.

3. My company is on a tight budget. Are there free CI tools?

There are options! Google Alerts is a basic yet effective way to track competitor mentions online. Many SEO and social listening tools offer free plans with limited features. Crunchbase has basic competitor profiles for free. The key is to be selective about what data you truly need before investing in paid platforms.

4. How often should I be doing competitive analysis?

CI shouldn't be a one-off task. Some data, like pricing changes, might need near-real-time monitoring. Other insights, like feature tracking, can be monitored monthly or quarterly. The frequency depends on how dynamic your industry is and the specific intelligence goals you outlined.

5. How do I share competitive insights across my organization?

Consider the urgency and format of insights. Urgent alerts on pricing changes might warrant a Slack message to the relevant team. Broader trends could be compiled into a monthly newsletter or presented in a team meeting. Choose communication methods that align with the type of data and the teams that need to act on it.

6. Isn't it unethical to track my competitors this closely?

Competitive intelligence focuses on publicly available information – websites, news, social media, etc. The line gets crossed when you engage in industrial espionage or steal proprietary information. There's a difference between monitoring a competitor's ad campaigns and hacking into their systems.

7. How do I convince leadership to invest in CI tools?

Focus on the ROI. Can you demonstrate how CI insights led to a pricing adjustment that boosted revenue, or helped close a deal by understanding a competitor's weaknesses? Framing CI as investment rather than a cost will make your case stronger.

8. What are some common mistakes to avoid in competitive analysis?

Two big mistakes are: Focusing solely on surface-level comparisons (they have feature X, we don't) without asking why that feature matters to customers. Secondly, getting lost in data without taking action on the insights. Competitive intelligence is only valuable if it drives decision-making.

9. What skills does my team need to be effective at competitive intelligence?

A mix of analytical thinking and strategic mindset is ideal. Your team needs the ability to spot patterns within data, connect those patterns to potential customer pain points, and translate that into recommendations for product, marketing, or sales.

10. Are there any industry-specific considerations for competitive intelligence?

Definitely! In highly regulated industries, there might be restrictions on the types of data you can collect. In fast-moving tech sectors, real-time monitoring becomes more crucial. Understanding the nuances of your industry landscape is a step towards tailoring your CI strategy.