In this comprehensive guide, we'll dive into the world of user surveys and discover how they can help SaaS marketers like you unlock valuable insights and drive exponential growth for your company.

"The most successful SaaS marketers treat user surveys as an ongoing conversation, continually adapting and evolving their strategies in response to user feedback."

You've poured your heart and soul into your SaaS product. You're confident that it's the best thing since sliced bread. But... are your users just as thrilled? Or are they struggling to see the value in your creation?

That's where user surveys come in. They're your secret weapon to understanding how your customers think, feel, and interact with your product. And when used effectively, they can give you the insights you need to tweak your strategy and drive incredible growth.

So buckle up, SaaS marketers. It's time to delve into the world of user surveys and discover how to harness their power for your company.

Table of Contents

- The Importance of user surveys for SaaS Marketers

- Types of user surveys: when and how to use them

- Crafting effective survey questions

- Maximizing survey response rates

- Analyzing and acting on survey results

1. The importance of user surveys for SaaS marketers

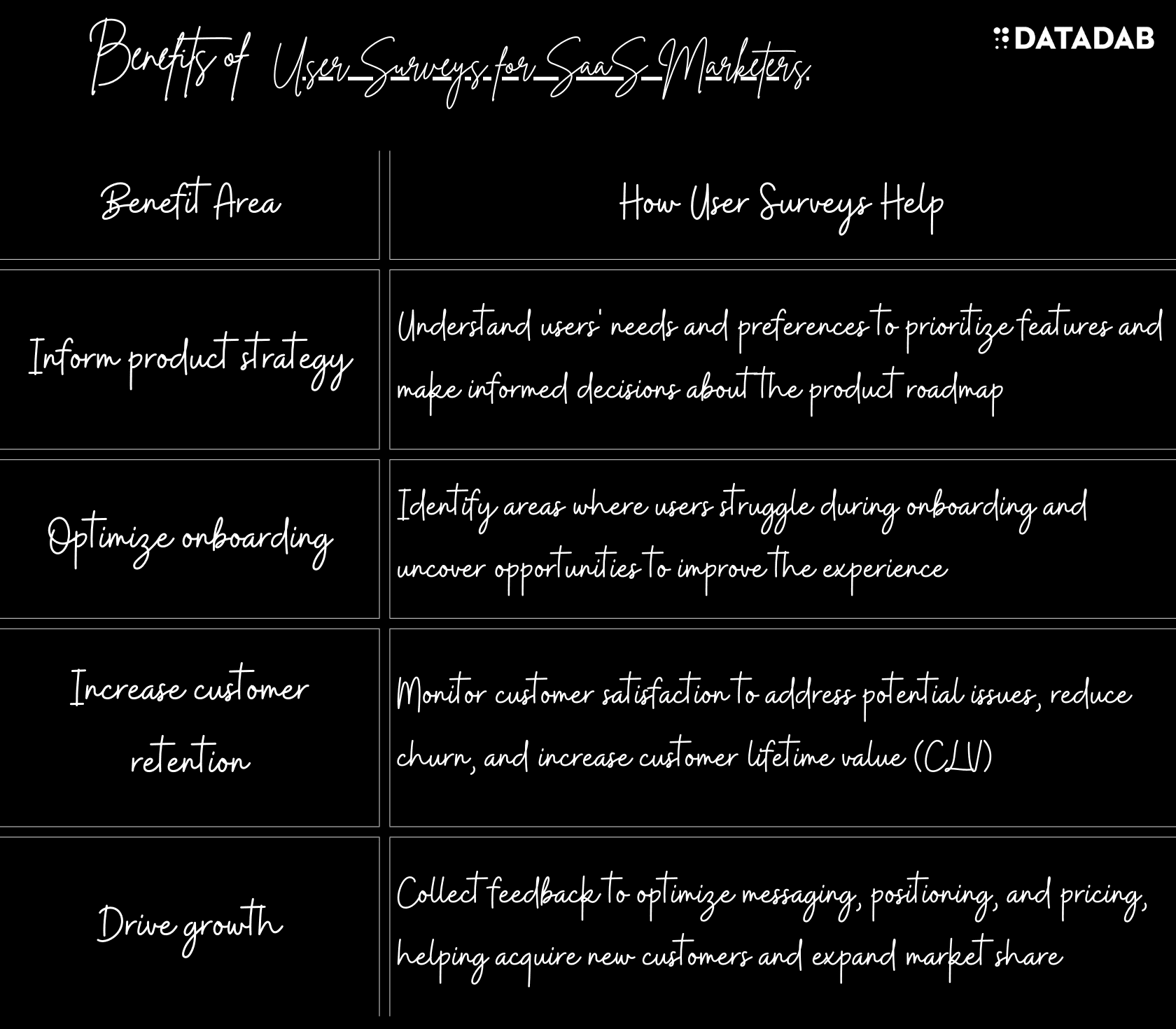

User surveys are essential for SaaS marketers because they provide valuable insights into customer behavior, preferences, and pain points. Here's a look at some of the key benefits:

- Inform product strategy: By understanding your users' needs and preferences, you can make more informed decisions about your product roadmap and prioritize features that provide the most value to your customers.

- Optimize onboarding: Pinpoint areas where users are struggling during onboarding and identify opportunities to improve the experience.

- Increase customer retention: Keep a pulse on customer satisfaction and identify potential issues before they escalate, reducing churn and increasing customer lifetime value (CLV).

- Drive growth: Use feedback to optimize your messaging, positioning, and pricing, helping you acquire new customers and expand your market share.

Did you know? According to a study by the Harvard Business Review, a 5% increase in customer retention can lead to a 25-95% increase in profits. So, investing in user surveys can have a significant impact on your bottom line!

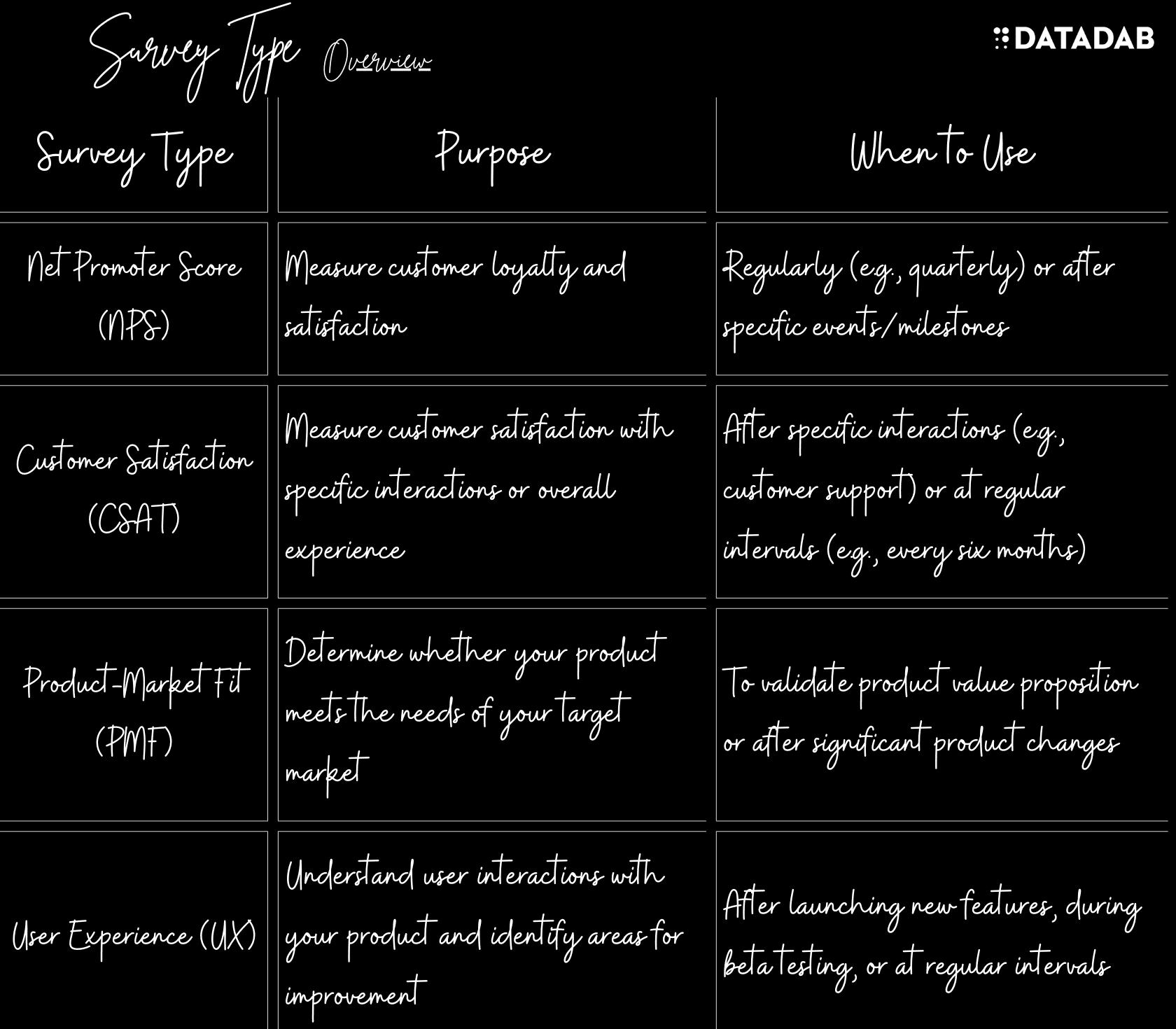

2. Types of user surveys: when and how to use them

There's no one-size-fits-all approach to user surveys. Different survey types serve different purposes, and knowing which one to use and when can make all the difference. Here are four popular survey types for SaaS marketers, along with tips on when and how to use them effectively:

A. Net Promoter Score (NPS)

NPS measures customer loyalty by asking users one simple question: "On a scale of 0-10, how likely are you to recommend [Product/Company] to a friend or colleague?"

Users are then grouped into three categories based on their scores:

- Promoters (9-10): Loyal enthusiasts who will keep buying and referring others.

- Passives (7-8): Satisfied but unenthusiastic customers who competitors could sway.

- Detractors (0-6): Unhappy customers who could damage your brand through negative word-of-mouth.

Your NPS is calculated by subtracting the percentage of Detractors from the percentage of Promoters.

When to use: Use NPS surveys regularly (e.g., quarterly) to track customer loyalty and satisfaction over time. They can also be triggered after specific events or milestones, such as completing onboarding or reaching a specific usage level.

How to use it effectively: Follow up the NPS question with an open-ended question asking users to explain their score. This will help you understand the reasons behind their ratings and uncover actionable insights.

B. Customer Satisfaction (CSAT)

CSAT surveys measure customer satisfaction by asking users to rate their experience with your product or service on a scale (e.g., "Very Unsatisfied" to "Very Satisfied").

When to use: CSAT surveys can be deployed after specific interactions (e.g., customer support interactions, onboarding completion) or at regular intervals (e.g., every six months) to gauge overall satisfaction.

How to use it effectively: Keep your CSAT survey short and focused on specific aspects of the user experience. Include open-ended questions to collect qualitative feedback and gain a deeper understanding of users' pain points and preferences.

C. Product-Market Fit (PMF)

PMF surveys help you determine whether your product is meeting the needs of your target market. The key question to ask is: "How would you feel if you could no longer use [Product/Company]?"

Options for answers include:

- Very disappointed

- Somewhat disappointed

- Not disappointed

When to use: Run PMF surveys when you're looking to validate your product's value proposition or when you make significant changes to your product to ensure you're still meeting the needs of your customers.

How to use it effectively: Aim for at least 40% of your users to respond with "Very disappointed." If you fall short of this benchmark, analyze the feedback to identify areas for improvement and iterate on your product.

D. User Experience (UX) Surveys

UX surveys focus on understanding how users interact with your product and identifying areas for improvement. They typically include questions about ease of use, navigation, design, and overall experience.

When to use: Deploy UX surveys after launching new features, during beta testing, or at regular intervals to monitor the user experience.

How to use effectively: Include a mix of quantitative (e.g., rating scales) and qualitative (e.g., open-ended questions) questions to gain a comprehensive understanding of user interactions with your product.

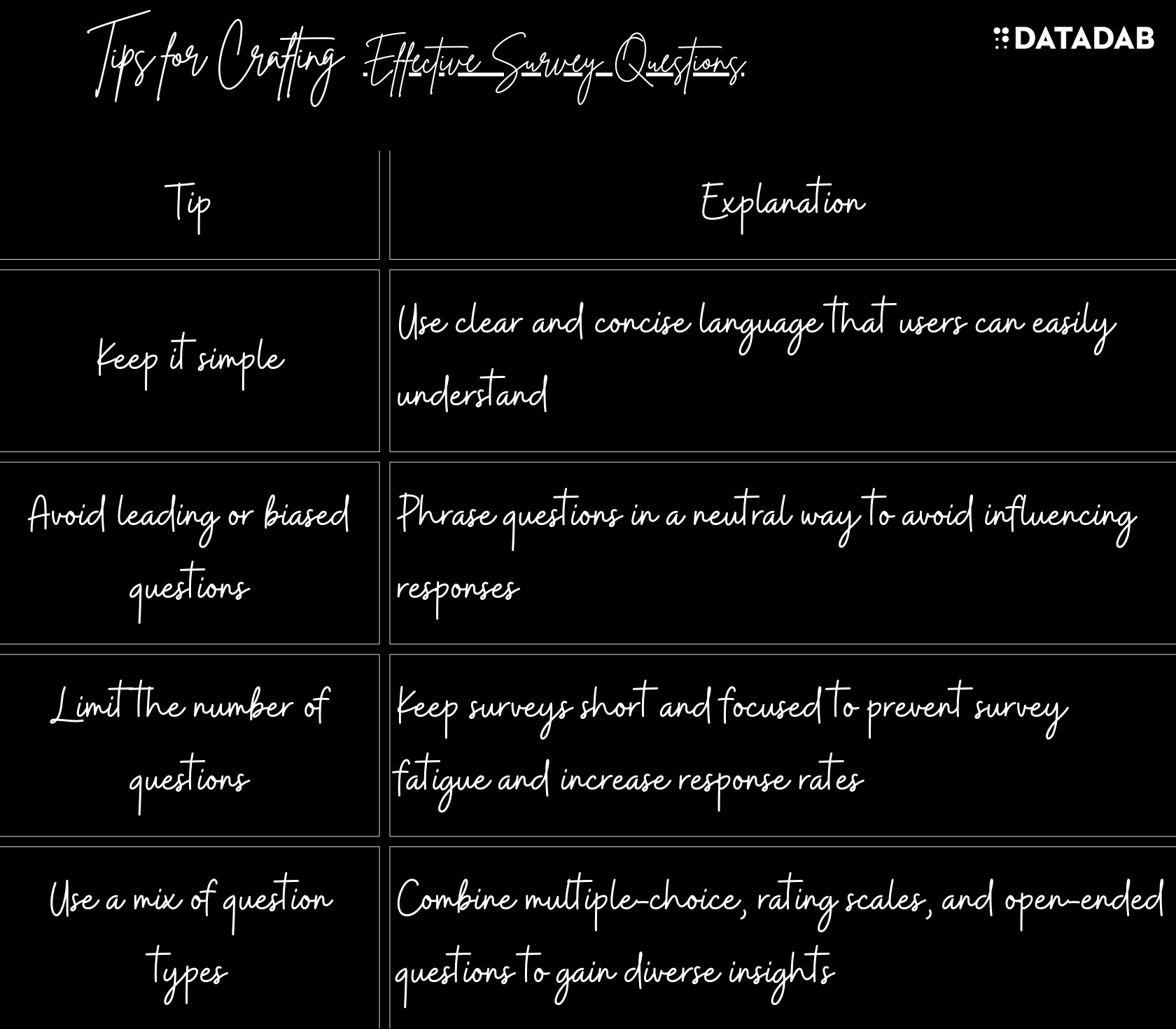

3. Crafting effective survey questions

The quality of your survey questions directly impacts the insights you can extract from the data. Here are some tips for crafting effective survey questions:

- Keep it simple: Use clear and concise language that your users can easily understand.

- Avoid leading or biased questions: Phrase questions in a neutral way to avoid influencing responses.

- Limit the number of questions: Keep your survey short and focused to prevent survey fatigue and increase response rates.

- Use a mix of question types: Combine multiple-choice, rating scales, and open-ended questions to gain both quantitative and qualitative insights.

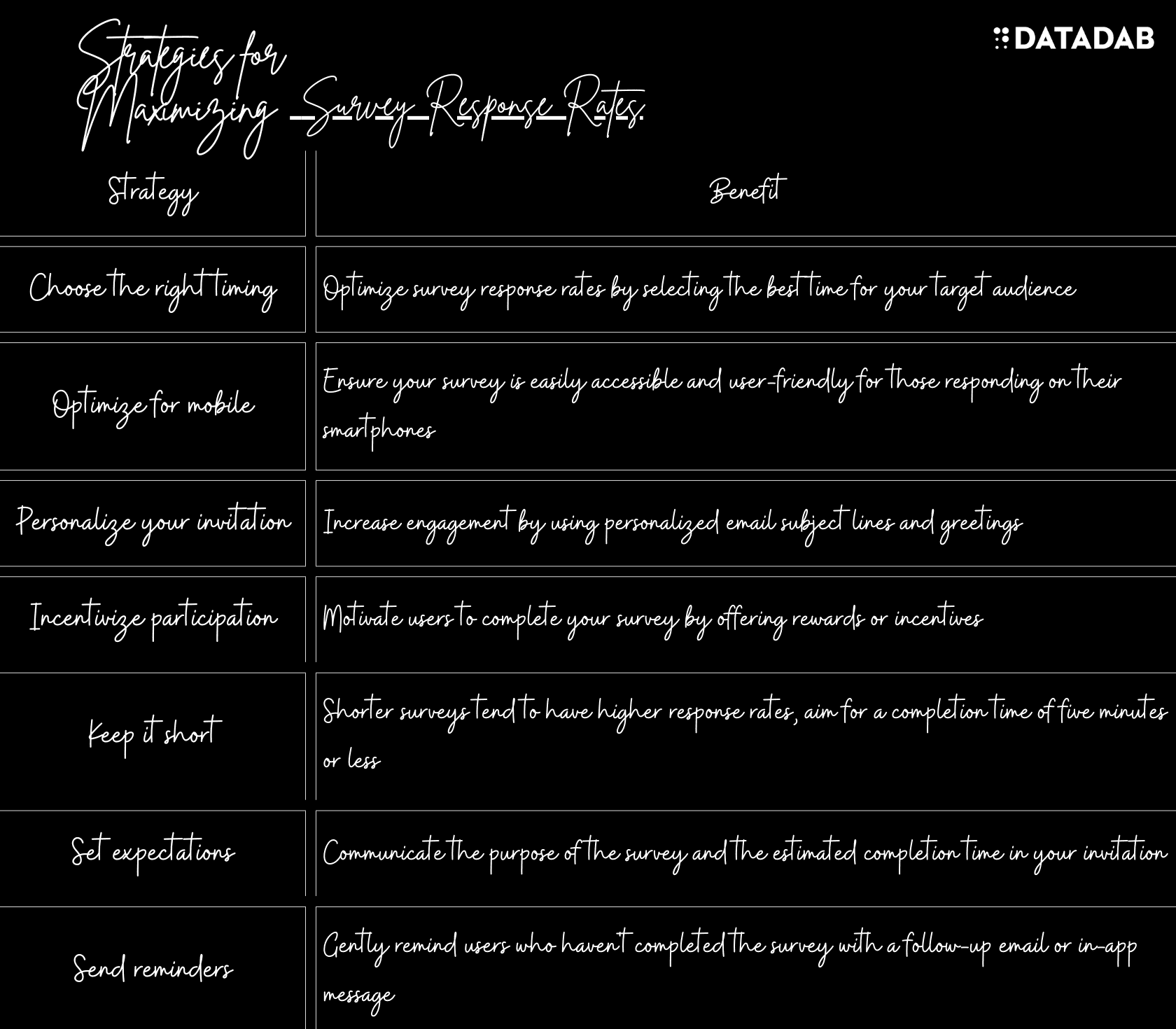

4. Maximizing survey response rates

Higher response rates lead to more reliable data and better insights. Here are some tips for maximizing your survey response rates:

- Choose the right timing: Send surveys at optimal times, such as after a user has reached a specific milestone or during low-activity periods for your target audience.

- Optimize for mobile: Ensure your survey is mobile-friendly, as a significant portion of your users may respond on their smartphones.

- Personalize your invitation: Use personalized email subject lines and greetings to increase engagement and make users feel valued.

- Incentivize participation: Offer rewards or incentives, such as gift cards or exclusive content, to motivate users to complete your survey. Be careful not to overdo it, though—too big an incentive could lead to biased responses. 5. Keep it short: As mentioned earlier, shorter surveys tend to have higher response rates. Aim for a completion time of five minutes or less.

- Set expectations: Communicate the estimated time it will take to complete the survey and the purpose of the survey in your invitation.

- Send reminders: Gently remind users who haven't completed the survey with a follow-up email or in-app message, but avoid spamming them with excessive reminders.

5. Analyzing and acting on survey results

Collecting survey data is just the beginning. The real magic happens when you analyze the data, extract insights, and take action. Here's a step-by-step process to help you get the most from your survey results:

- Organize your data: Compile your survey responses in a centralized location, such as a spreadsheet or data visualization tool, to make analysis easier.

- Identify trends: Look for patterns in the data, such as high or low scores in specific areas, common pain points, or recurring suggestions for improvement.

- Segment your data: Break down your data by user segments (e.g., by plan type, job title, or company size) to uncover insights that may be unique to specific groups.

- Triangulate your findings: Compare your survey results with other data sources, such as product usage data or customer support tickets, to gain a more comprehensive understanding of your users' needs and experiences.

- Prioritize action items: Use your insights to identify the most critical areas for improvement and prioritize them based on potential impact, effort required, and alignment with your strategic goals.

- Communicate your findings: Share your survey results and action plans with your team and relevant stakeholders to ensure everyone is on the same page and working towards the same goals.

- Close the loop with users: Let your users know how their feedback has informed your strategy and the improvements you've made. This will not only demonstrate that you value their input, but also help build trust and loyalty.

User surveys are a powerful tool for SaaS marketers looking to gain valuable insights, inform strategy, and drive growth.

By understanding the different types of surveys, crafting effective questions, maximizing response rates, and analyzing results, you'll be well on your way to unlocking your product's full potential and delighting your users.

So, what are you waiting for? Start tapping into the power of user surveys today and watch your SaaS business thrive!

FAQ

1. How do I choose the right type of survey for my SaaS business?

Choosing the right type of survey depends on your business goals and the insights you're looking to gain. Consider the following:

- NPS surveys are ideal for measuring customer loyalty and satisfaction over time.

- CSAT surveys work best for gauging customer satisfaction with specific interactions or the overall experience.

- PMF surveys help you determine whether your product is meeting the needs of your target market.

- UX surveys are useful for understanding how users interact with your product and identifying areas for improvement.

Review your current business challenges and determine which type of survey will provide the most valuable insights to address those challenges.

2. How often should I conduct user surveys?

The frequency of user surveys depends on the type of survey and your specific business needs. As a general guideline:

- NPS surveys can be conducted quarterly or after specific events/milestones.

- CSAT surveys can be deployed after specific interactions (e.g., customer support) or at regular intervals (e.g., every six months).

- PMF surveys should be run when validating your product's value proposition or after significant product changes.

- UX surveys can be used after launching new features, during beta testing, or at regular intervals to monitor user experience.

It's essential to strike a balance between gathering valuable insights and avoiding survey fatigue among your users.

3. What's the ideal survey length to maximize response rates?

The ideal survey length should be short and focused to prevent survey fatigue and increase response rates. Aim for a completion time of five minutes or less. Limit the number of questions and prioritize those that will provide the most valuable insights for your specific goals.

4. How can I improve the quality of my survey questions?

To improve the quality of your survey questions:

- Use clear and concise language that users can easily understand.

- Avoid leading or biased questions by phrasing them in a neutral way.

- Keep your survey short and focused on specific aspects of the user experience.

- Use a mix of question types (multiple-choice, rating scales, and open-ended questions) to gain diverse insights.

5. How can I encourage more users to complete my surveys?

To encourage more users to complete your surveys:

- Choose the right timing by sending surveys during low-activity periods or after specific milestones.

- Optimize your survey for mobile devices, ensuring it is easily accessible and user-friendly.

- Personalize your survey invitation with tailored email subject lines and greetings.

- Offer incentives or rewards to motivate users to complete the survey.

- Set expectations by communicating the survey's purpose and estimated completion time in your invitation.

- Send gentle reminders to users who haven't completed the survey.

6. How do I analyze qualitative feedback from open-ended questions?

To analyze qualitative feedback:

- Organize responses by categorizing them based on common themes, pain points, or suggestions.

- Identify recurring issues or trends that may warrant further investigation or action.

- Consider using text analysis tools or qualitative data analysis software to help streamline the process and uncover deeper insights.

7. How can I use survey data to prioritize product improvements?

Use the insights from your survey data to identify the most critical areas for improvement. Prioritize action items based on:

- Potential impact on user satisfaction, retention, or growth.

- Effort required to implement the changes.

- Alignment with your strategic goals and product roadmap.

8. How can I ensure that my survey results are representative of my user base?

To ensure your survey results are representative:

- Aim for a high response rate by following the tips mentioned earlier in this FAQ.

- Monitor the demographics of your survey respondents and compare them to your overall user base to identify any discrepancies or underrepresented groups.

- Consider using stratified sampling or quota sampling techniques to ensure your survey results accurately represent your user base.

- Validate your survey findings by cross-referencing them with other data sources, such as product usage data or customer support tickets.

9. How should I share my survey findings with my team and stakeholders?

Sharing your survey findings effectively involves:

- Summarizing key insights, trends, and action items in a clear and concise manner.

- Creating visual aids, such as charts and graphs, to help illustrate your findings and make them more accessible.

- Presenting your findings in a team meeting, company-wide presentation, or a written report to ensure all relevant stakeholders are informed.

- Engaging in a discussion about the survey results to address any questions or concerns and gather additional feedback from your team.

10. How do I close the loop with users after conducting a survey?

Closing the loop with users after conducting a survey involves:

- Thanking users for their participation and highlighting the importance of their feedback.

- Sharing a summary of the key findings and insights from the survey, as well as any resulting action items or improvements.

- Providing updates on the progress of implementing changes based on the survey feedback.

- Inviting users to participate in future surveys or other feedback opportunities to continue the conversation and demonstrate your commitment to continuous improvement.

By closing the loop with users, you show that you value their input and help build trust and loyalty, which can contribute to the long-term success of your SaaS business.