“Amit, I got into this business to help my clients manage their finances, not market myself. I’ll focus on referrals and leave the advertising to others. More importantly, I don't even know where to begin”!

I understand the sentiment. Most advisors pursue this profession because they love helping people and find meaning in improving lives through guidance around finances.

However, I’ve learned exceptional marketing and sales rarely contradict an advisor’s higher calling. In fact, they enable it.

Dedicated marketing brings together advisors and ideal prospective clients needing their service. Handled ethically, it allows topping up the reservoir of individuals to serve without taking time away from current relationships.

Ignore this reality in today’s competitive, online environment and your ability to live out your purpose gets strangled by the lack of new opportunities. Embrace this reality and you build a stage allowing ever greater influence.

After refining dozens of successful programs for wealth managers over the years, I’m sharing my team’s collective knowledge on what works when strategically marketing an advisory practice today...

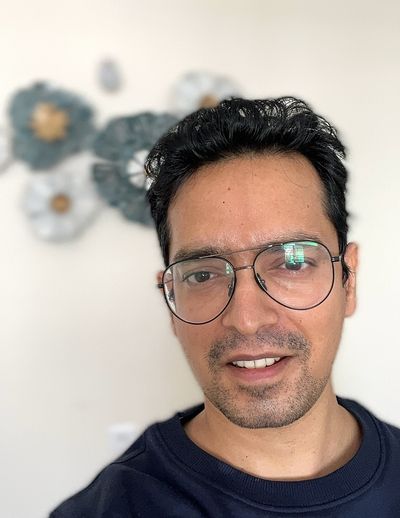

Understand Your Target Clients Deeply

The foundation of advisor marketing is knowledge—not just of markets or products, but of the people you aim to serve. Develop a keen understanding of current and prospective clients by regularly asking questions like:

- What financial goals and priorities do they have?

- What worries or objections might they have working with an advisor?

- How do they prefer to take in information and communicate?

- What media, influencers, and information sources do they already rely on?

Armed with specific psychographic and demographic insights, you can craft messaging and choose channels tailored to motivate your ideal customers.

For example, one advisor client of ours targeted young tech entrepreneurs. We discovered this audience strongly valued self-service and mobile responsiveness, two needs many advisors overlook when marketing to the affluent. By showcasing his secure online portal and easy mobile access in ads, this client increased sales conversions by 34% that year among his key segment.

Marketing Audit Checklist

Conduct this audit annually to identify areas for optimizing your marketing approach.

Website

- [ ] Mobile responsiveness confirmed

- [ ] Page speed grade of A/B via Google PageSpeed Insights

- [ ] Contact + lead gen forms have clear CTAs

- [ ] Value proposition / differentiators clearly highlighted

- [ ] Client avatar alignment assessed

- [ ] Blog content > 25 posts, >2000 words total

Search Engine Optimization

- [ ] No critical errors on Google Search Console

- [ ] Metadata, tags, alt text for images defined

- [ ] Site content employs strategic keywords

- [ ] Local listings registered & confirmed

Paid Ads

- [ ] Google Ads accounts set up

- [ ] Active ad variations in place for testing

- [ ] Negative keywords added to block irrelevant clicks

- [ ] Audiences properly segmented

Analytics

- [ ] Google Analytics account connected

- [ ] Goals & conversion tracking installed

- [ ] Meaningful dashboards configured

- [ ] Source/medium tagging working

Social Media

- [ ] Profiles set up on key platforms

- [ ] Recent posts / follower engagement assessed

- [ ] Employee advocacy policy in place

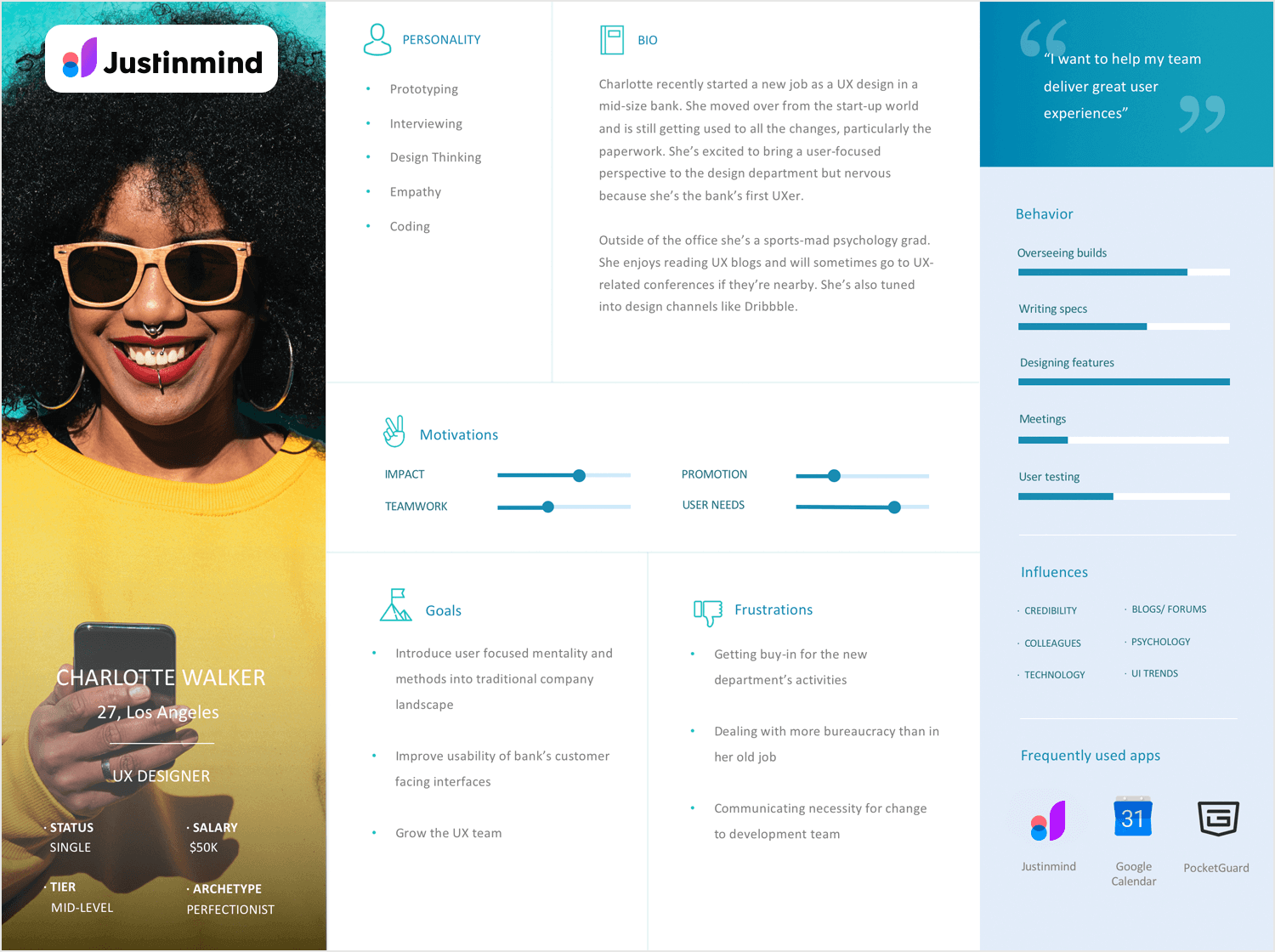

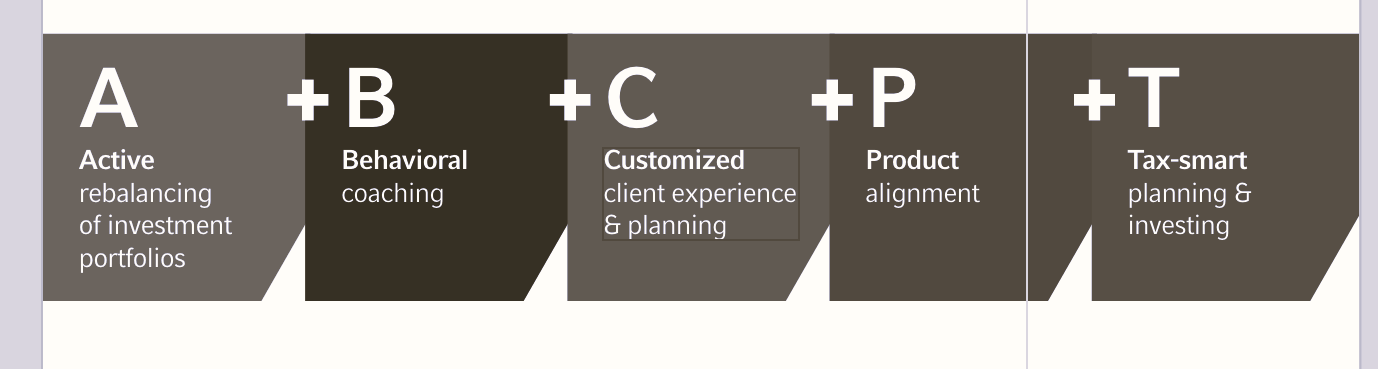

Identify Your Differentiating Value

Prospective clients have unlimited options today. Standing out requires defining and communicating your unique advisor value proposition (AVP). Ask yourself:

- What problem do I solve exceptionally well for clients compared to alternatives?

- What value-added services or specialized expertise do I offer that few competitors can match?

- What exceptional client experiences and relationships do I provide?

To resonate emotionally with your audience, translate functional capabilities and offerings into client outcomes. For instance, an advisor may handle complex trust services few in his area provide. But focusing ad messaging on the intricacies of trust administration won’t motivate prospects emotionally. Instead, discuss how your expertise leads to outcome prospects care about, like:

- Preserving family wealth across generations

- Achieving tax efficiency to enhance performance

- Reducing stress through customized wealth transfer solutions

This advisor could even highlight client testimonials who have realized these outcomes thanks to his uncommon trust services expertise.

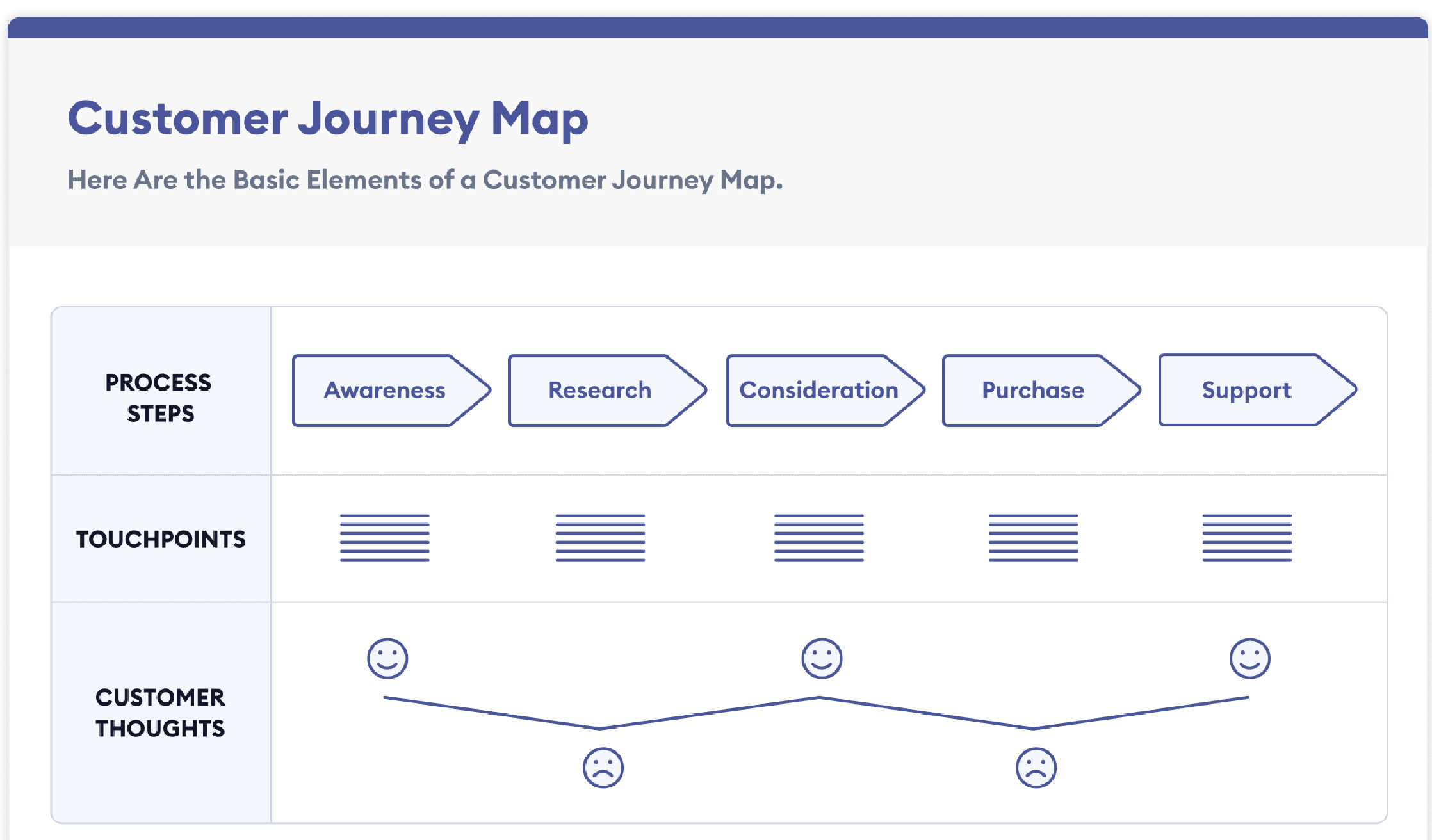

Choose Marketing Channels Aligned to Buying Journeys

Today’s buyers engage in extensive online research before ever contacting an advisor. In fact, by the time a prospect reaches out, they are nearly 60% through the consideration journey.

To maximize conversions, expose your differentiated AVP to prospects multiple times across channels which align to their buying process. Classic client acquisition funnels might include:

Awareness Phase

- Search ads

- Social media ads

- Print or online business profiles

- Public speaking engagements

Interest Phase

- Educational blog content

- Financial planning seminars

- Client event invitations

Decision Phase

- Targeted email nurturing

- Review gathering

- Single Page websites

Onboarding

- Branded presentation materials

- Welcome packages

This multichannel, multitouch attribution journey moves prospects smoothly through consideration to conversion. Each branded message or interaction reinforces perception of your differentiation and builds trust.

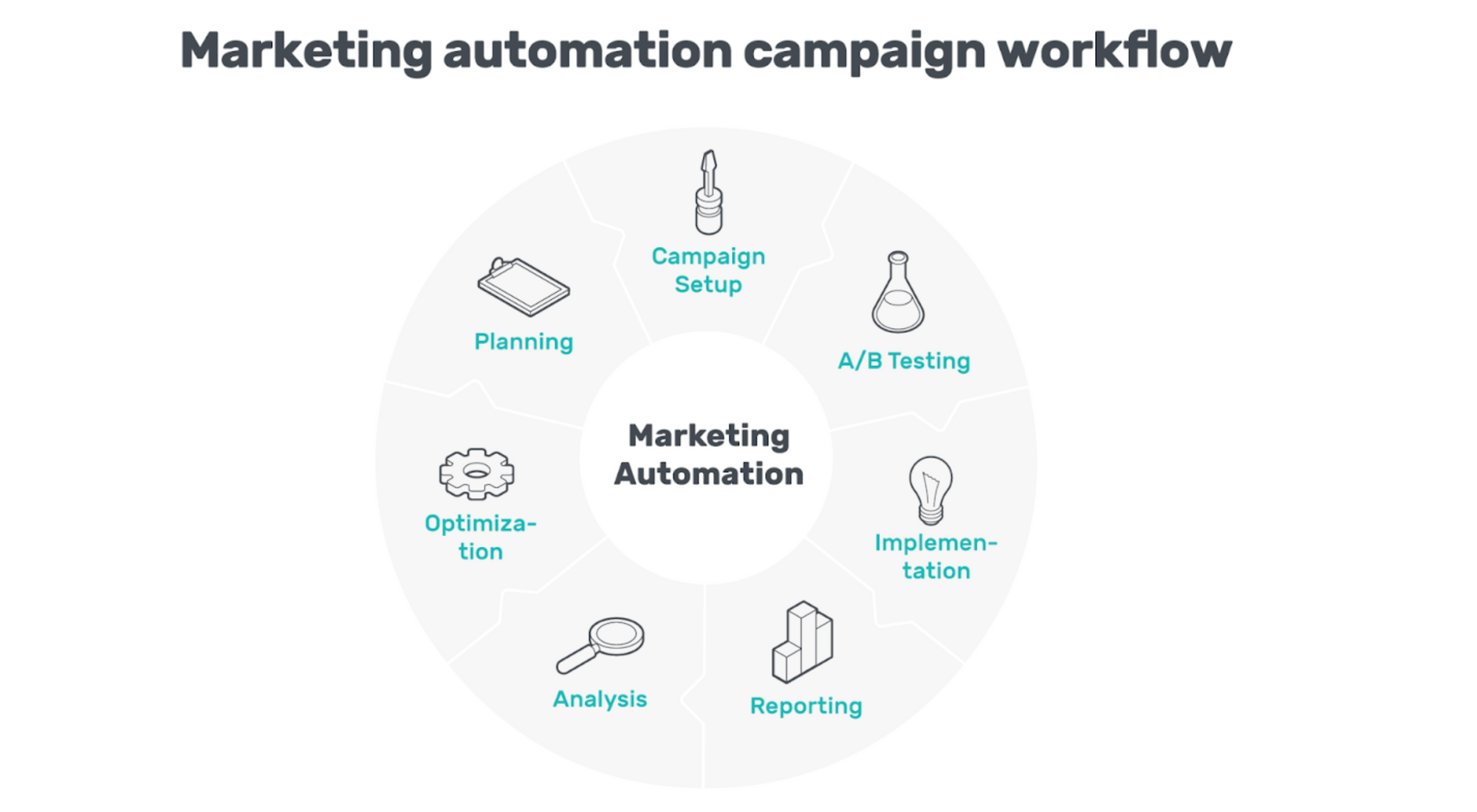

Automate Marketing Tasks

Marketing responsibilities can overwhelm the busy advisor focused on client service. The solution? Identify manual tasks consuming time without significant ROI which could benefit from automation.

![14 Best Marketing Automation Software Tools [2023 Update]](https://www.tidio.com/wp-content/uploads/marketing-automation-example-bot-1200x744.png)

For instance, dedicating just 5% of your workweek to blogging helpful educational content may position your expertise far better than sporadic postings as you find time. This process is easily systematized by:

- Blocking out designated writing time on your calendar

- Pre-planning article topics and themes

- Using AI writing assistants to draft post outlines for review

- Working with freelancers or agencies to polish posts

Similarly, manually emailing articles and commentary to your database requires time without personalization. Automated email sequences integrated with your CRM allow more relevant, tailored client conversations at scale.

Test and Optimize Relentlessly

Today’s marketing best practices may become obsolete within a few years. Dynamic testing and optimization provide the key to staying ahead.

I advocate advisors dedicate at least 10% of total marketing budgets specifically to experiments improving conversions. Unlike generalized brand advertising, direct response digital channels allow continually testing messages, offers, and creatives to identify what best motivates your audience.

For example, one large RIA client sought to move clients towards fee-based accounts to facilitate growth. Testing demonstrated a short explanatory video on their website emphasizing the alignment of incentives in fee-based models tripled account conversion rates over standard text positioning.

No advisor has unlimited resources. Rigorous testing reduces wasted spend on underperforming tactics so you can reinvest in what works.

Invest in Marketing Technology

While advisors rightfully focus investment towards improving client outcomes, allocating capital towards marketing technology boosts acquisition of new ideal clientele.

Top marketing and sales stacks today include:

- CRM – Centralize data on prospects, clients, activities etc. to enhance personalization.

- Marketing Automation – Nurture buyers during their journeys using triggered email, text, or ads.

- Analytics – Identify the highest converting marketing assets and channels to optimize.

- Advertising Tools – Create and manage paid search, social, and display ad campaigns.

While buying best-of-breed point solutions for each capability seems appealing, I’ve found integrated suites like HubSpot or Salesforce eliminate complexities stitching separate technologies together.

Allocate at least 10-15% of your total marketing budget towards proven technologies boosting your advisors’ productivity and effectiveness. Discount broader firm investments in related solutions like cybersecurity protections, web development and hosting, etc.

Develop Talent and Offer Ongoing Training

As fiduciaries, clients rightfully hold advisors to the highest standards of competence and professionalism. Marketing equally requires specialized skills and knowledge around positioning, messaging and analytics. Dedicate resources towards developing your team’s capabilities or consider external partnership.

Ideally, advisors receive formal marketing training across:

- Digital Strategy – How technology transforms modern buyer journeys

- Content Creation – Structuring educational articles, videos, etc. which attract and retain ideal clients

- Social Media – Developing organic presences across key platforms like LinkedIn

- Advertising – Creating aligned paid campaigns across channels

Schedule quarterly continuing education workshops or events to help advisors and internal marketing staff stay abreast of this rapidly changing domain. For broader teams, short monthly tactical trainings focused on platform updates or campaign optimization tactics keep skills current.

For independent advisors or smaller firms lacking specialized marketing talent, retain fractional consultants or agencies providing strategic direction coupled with production support executing campaigns, content development and reporting.

While marketing may remain an advisors’ least favorite professional responsibility, those committing to continuous skills development and partnerships build valued client advisory practices that thrive regardless of market shifts and competitive threats. This responsibility only grows as rising generations conduct nearly all initial research online before ever scheduling a first meeting. Those who embrace marketing’s foundational role within client acquisition today secure tomorrow’s success.