"Customers often have a precise number in their heads that represents the maximum they're willing to spend. Your job is to find that magic number."

Pricing. Let's face it—it freaks most of us out.

You've poured months, maybe years into building a product to solve real problems for real people. And every fiber of your being shouts it offers tremendous value.

But will those people actually pay you for it? And how much is fair to ask without getting laughed off the web?

I've been there too. Staring blankly at a pricing page, the cursor angrily blinking as if to say: “Well...what now?”

It's overwhelming. Risky. Confusing. Not what many of us signed up for when we set down the entrepreneurial path.

But pricing a product correctly is table stakes if turning an idea into a thriving business.

And here's the good news—you don't have to tackle pricing blindly. Or rely on guesses, hunches or (God forbid) competition alone to set numbers.

There's a better way. A strategic way rooted in understanding value rather than hoping it sticks. A way that transforming meaningful customer problems into tangible revenue depends upon.

This guide shares field-tested tactics to uncover what customers are truly willing to pay, so you can price both profitably and fairly.

I'll walk through:

- Asking openly without awkwardness

- Watching behavior over believing promises

- Testing pricing like you test products

- Understanding the “rules” in your space

These approaches helped me unlock pricing for multiple SaaS ventures and guide clients to revenue growth using willingness data.

So whether early stage or scaled, let these insights provide a playbook to setting pricing with conviction versus apprehension.

Because customers want to pay you. You just need to cleverly have them tell you how much 😉.

Conduct Willingness-to-Pay Studies

One of the most direct ways to gauge willingness-to-pay is to simply ask customers and prospects outright how much they would pay for your offering.

There are a few effective formats here:

Direct Open-Ended Questions

Simply ask customers “How much can you pay for [X product]?” Open-ended questions allow you to get unbiased estimates from customers in their words. Pay attention to ranges and clustering around certain price points.

Tiered Pricing Surveys

Present 3-5 pricing tiers and ask customers to select the option they would be willing to pay. For example:

| Plan | Price |

|---|---|

| Basic | $20/mo |

| Professional | $50/mo |

| Premium | $100/mo |

The distribution of responses will reveal price sensitivity and willingness levels.

Conjoint Analysis

Show different product/pricing combinations with variations in features and pricing. This helps reveal which attributes are most important in driving willingness to pay. For example:

| Plan | Price | International Calls | Storage | Support | Would Pay |

|---|---|---|---|---|---|

| A | $15/mo | ❌ | 50 GB | ✅ | |

| B | $30/mo | ✅ | 200 GB | 24/7 Chat | ❌ |

The selections made reveal customer preferences and decision motivators.

No matter the format, willingness-to-pay surveys and studies should be conducted periodically to stay on the pulse.

Talk to Your Customers (Especially Churned Ones)

Surveys provide quantitative data, but having real conversations with customers also offers invaluable qualitative insights into pricing tolerance levels.

Customer Interviews

Pay attention to any unprompted mentions of pricing when interviewing clients, including:

- Feedback that your product is “expensive” or “cheap”

- Asking about discounts or lower-priced tiers

- Choosing competitor options based primarily on price

Also, listen for signs that customers may see your product as underpriced. This could indicate room to increase willingness-to-pay levels.

Analyze Churn Drivers

Make a habit of reaching out to churned clients. Ask if pricing played any role in their decision to leave. The feedback can reveal if your pricing exceeds willingness-to-pay for some segments.

Also, pay attention to adoption and retention patterns across plan tiers. If most new customers sign up for your low-tier option, it likely indicates that's the ceiling of what many are willing to pay.

Test Different Pricing Models

While surveys and conversations are helpful, you also want hard behavioral data around actual willingness-to-pay.

Experimenting with different pricing packages and promotions provides concrete signals into where pricing tolerance thresholds really stand.

A/B Test Plan Options

Mirror your pricing survey tiers in actual paid plans. Then A/B test the plans by offering different segments higher- or lower-priced options. Gauge conversion rates to see which price points drive the most traction.

Try Discounted Intro Offers

Temporarily discount initial sign-ups to acquire customers, but keep renewals at regular pricing. If uptake remains consistent through renewals, it signals customers do see ongoing value in staying at regular rates.

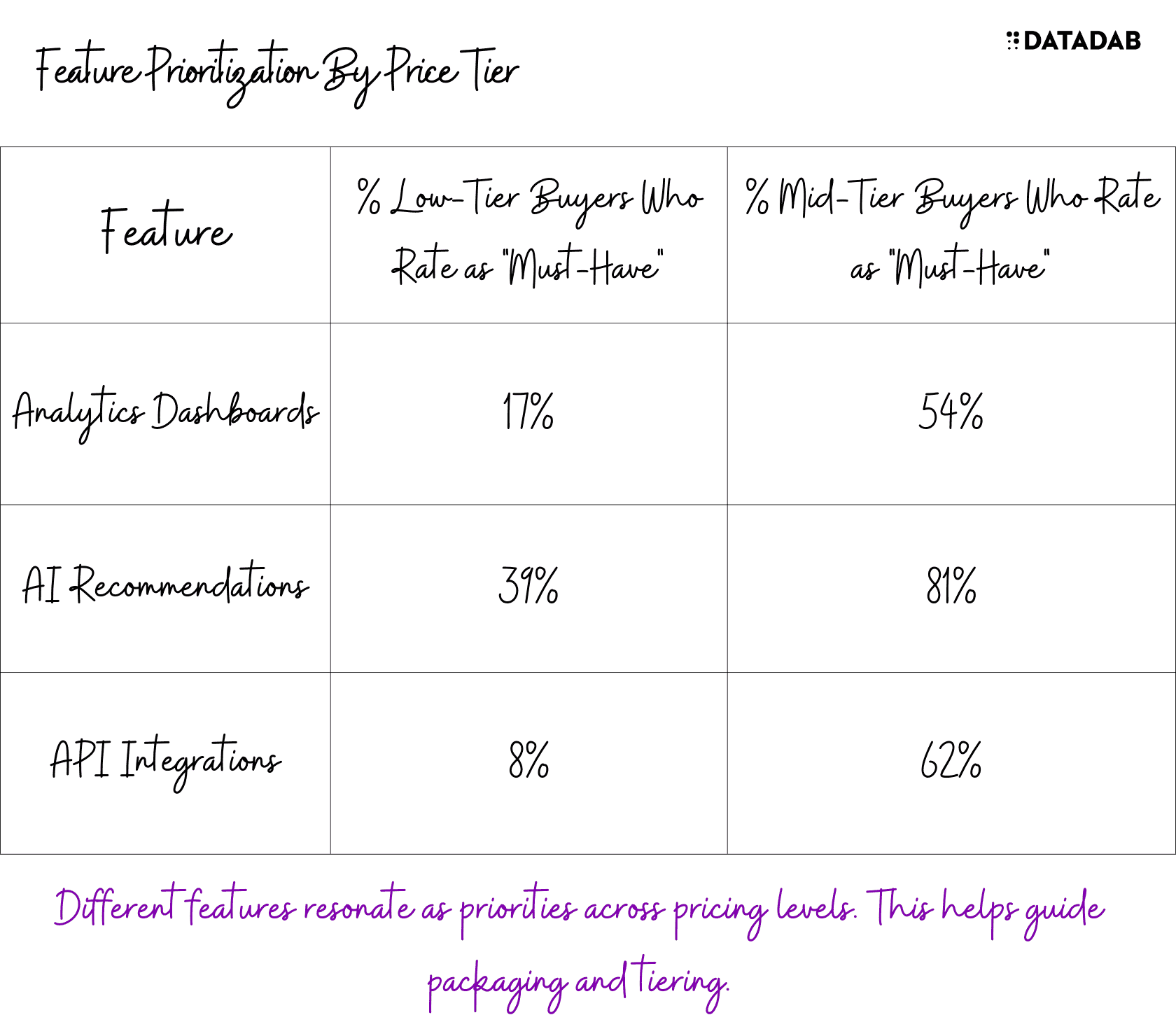

Bundle Different Feature Sets

Test subscriber interest by locking certain features behind higher-priced tiers or add-on packages. This reveals the monetary value users ascribe to specific functionality.

Understand Tables Stakes in Your Category

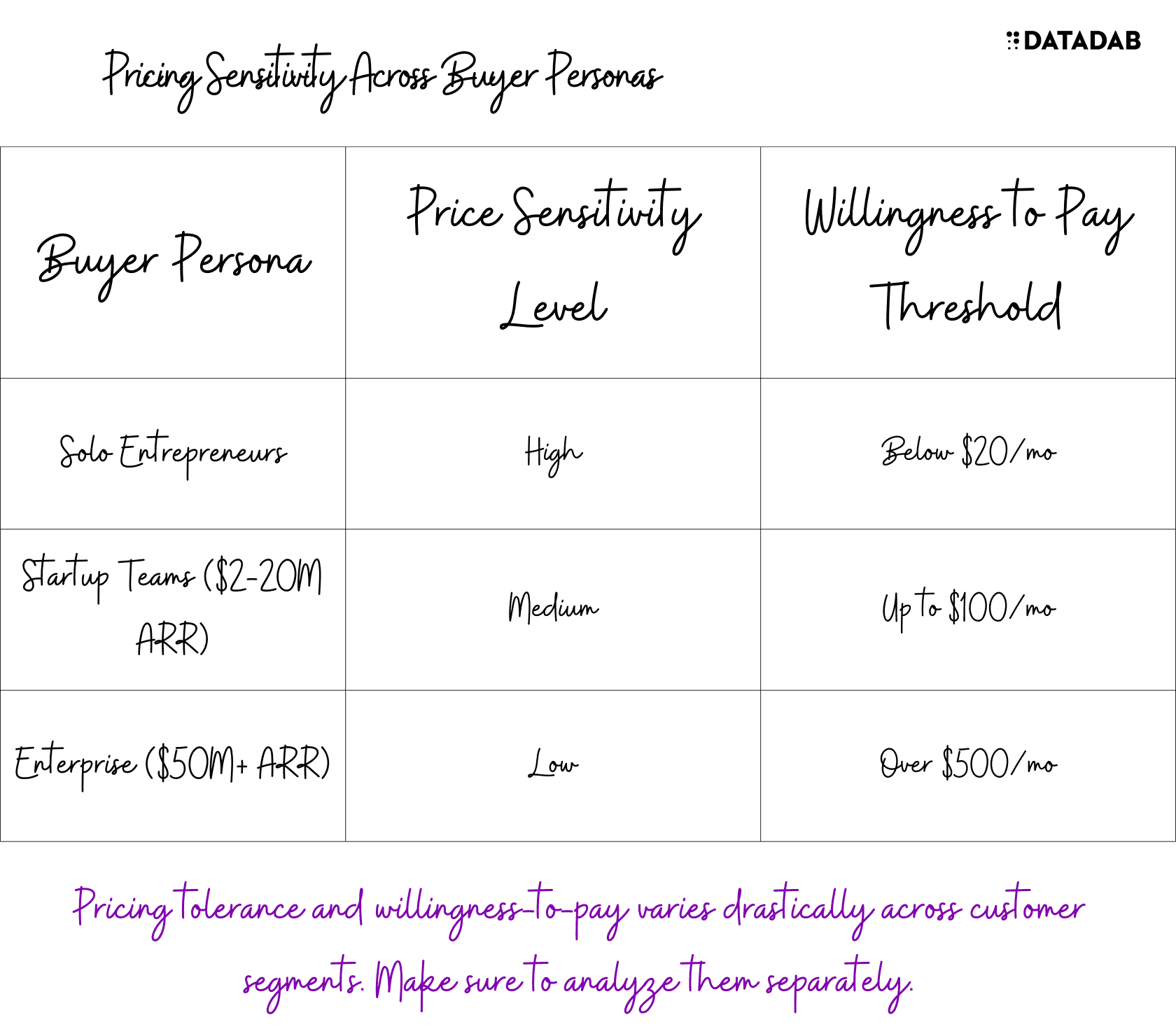

While every product and market is unique, it's important to ground expectations in broader pricing norms and customer benchmarks:

- Use comparables: Research pricing tiers from competitive products, especially more well-established ones. This can reveal category-wide willingness levels.

- Factor in budgets: Consider the budgets your target personas likely have to devote specifically to the problem you solve. That heavily dictates tolerance.

- Study adjacent spaces: Look at pricing in adjacent software categories selling to the same personas. Their normalized spending signals general willingness.

- Talk to veterans: Speak to veteran SaaS executives who have sized multiple markets. Their experience gives perspective on reasonable ranges.

Leveraging these external data points, combined with internal signals from customers themselves, provides a 360-degree view into pricing expectations and realities.

While willingness-to-pay differs drastically across products, personas, and categories, these tactics offer a blueprint to pinpoint that elusive sweet spot for your business. And small adjustments to better match customer pricing tolerance can have a dramatic impact.

After just a 5% pricing tweak using the above willingness analysis, we've seen clients increase new customer conversion rates by over 25%. And we've supported other companies to double renewals simply by packaging features to align better with what existing subscribers were already demonstrating a willingness to pay for in behavioral usage.

So while pricing decisions inevitably involve some level of art on top of science, dedicating real focus to willingness levels can ensure you're making smart bets steeped in actual data.

The above provides actionable methods to start instrumenting and gaining those pricing insights today across your customer base. Just remember to keep willingness assessments evergreen - revisit and often reevaluate as products improve and new buyers emerge.

What other best practices have you found useful for willingness-to-pay analysis? Any examples of how pricing adjustments based on these strategies impacted business growth? I'd love to hear other real-world lessons and exchange ideas.

FAQ

1. Why is understanding willingness to pay so important when pricing a SaaS product?

Clearly establishing customer willingness to pay is critical for finding optimal pricing that maximizes the value captured from customers. Price too low, and you leave money on the table while conditioning customers to undervalue your product. Price too high and adoption suffers. Aligning pricing tiers to willingness levels, backed by concrete customer data, helps split the difference to attract and monetize customers. Misalignment risks revenue leakage or stalled growth at some level.

2. What are some common mistakes companies make when evaluating willingness to pay?

Three common pitfalls include:

- Relying solely on qualitative feedback vs. quantified analysis: Asking customers casually “would you pay for this?” leads to inflated estimates not grounded in behavior. Quantifying through surveys and experiments counters this.

- Failing to test pricing regularly: Willingness thresholds evolve as products grow more sophisticated and markets mature. Frequent assessment is required to stay current.

- Not segmenting analysis: Treating all customers as equal skews results. Break out willingness by customer size, persona, region, etc. to uncover real variation.

3. If customers say they can't afford a higher price tier during sales conversations, should you automatically lower pricing?

Not necessarily. Customers often anchor budget-related pushback in arbitrary early approximations not perfectly reflective of actual value to their business from a solution. Probe deeper into the specifics of budgets allocated to solve the particular pain point you address. Then explore whether proposed tiers would reasonably deliver ROI exceeding their pricing in your customer's specific context. The goal is uncovering angles where greater willingness to pay than initially suggested may exist, despite knee-jerk budget responses.

4. How can you leverage willingness-to-pay data to optimize monetization beyond just setting pricing levels?

Willingness insights should guide packaging of features/capabilities across editions and tiers. They aid in bundling functionality that users show willingness to pay incremental amounts for together into commercial packages. These insights also inform expansion revenue playbooks on whom to target with high-value upsells based on indicated willingness.

5. If a customer churns soon after a price increase, does it always mean they exceeded their willingness to pay?

Not necessarily. Look deeper through win/loss and exit analysis. Many factors beyond pricing contribute to churn. Isolate whether pricing truly was the driver by directly asking. Dissect usage patterns before cancelling to check for other signals like declining engagement over time. While churn triggers should flag willingness concerns, make sure to fully diagnose the root cause before making conclusions.

6. How can you measure enterprise willingness to pay when volume and custom negotiations muddy standard pricing?

Leverage metrics like average deal size or net ARR expansion by customer cohort over time. Also collate custom quotes and analyze discount levels granted off list pricing by tier and category of enterprise customer. These quantified views build understanding of realized willingness levels. Qualitatively, corroborate through account manager team feedback on large enterprises' anchoring and guardrails in negotiations.

7. When selling to SMBs, what creative tactics can gauge willingness to pay?

SMBs require innovative approaches to willingness assessment given limited individual deal sizes. For example, deploy dynamic discount testing that serves different short-term “sales” to various segments at randomized price points. Or leverage usage-based pricing models for initial land that offer glimpses into willingness to pay as engagement scales. Free-to-paid conversion offers also illustrate at what point value overcomes inertia.

8. How could you structure pricing page testing to reveal willingness levels?

Set up multivariate tests that serve different visitors different pricing pages highlighting alternate plans. Gauge conversion rates through the funnel across pages. Also, dynamically test discounts and coupons at checkout to see marginal impact on conversions relative to list rates. Both isolation and incrementality testing exposes conversion lift potential at varied price thresholds.

9. What role does customer lifetime value (LTV) play in willingness-to-pay models, if any?

While willingness levels focus on maximizing initial capture, customer LTV dictates upper bounds based on downstream value. Even if evidence supports the ability to charge much higher entry pricing, extraction must align to ongoing value exchange. High early monetization out of sync with full lifecycle experience risks regret and churn. So willingness equates to an instantaneous limit, while LTV frames the long-term ceiling.

10. When evaluating competitors' pricing, which nuances are important?

Carefully catalog included capabilities, service elements, levels of support, ease of doing business, and prestige perceptions across tiers - not just absolute pricing levels. These all contribute “effective price” relative to your offering. Also assess vertical-specific pricing if relevant given meaningfully different value chains. Avoid false apples-to-apples based on headline SaaS rates lacking fuller context.