"We optimized every step of our onboarding funnel to remove friction and get customers experiencing value quickly."

- Eric Yuan, CEO of Zoom

I'm always keenly interested in understanding what makes some software companies hugely successful while others fade into obscurity. I've noticed over the years that the winners all seem to nail the SaaS business model in their own way.

Intrigued, I decided to study the playbooks of Salesforce, Slack, Zoom, Shopify, and Datadog. These are some of the biggest SaaS success stories, with meteoric growth and multi-billion dollar valuations. I wanted to uncover what set them apart.

What I discovered validated much of my own experience about what makes an effective SaaS business. As agencies, we need to deeply understand product-market fit, frictionless onboarding funnels, and viral adoption models. Leveraging these allows us to help clients achieve the kind of exponential expansion that these titans of tech have tapped into.

By learning these success stories, agencies like mine can better guide clients towards unlocking transformational growth. The examples set by these SaaS pioneers showcase proven frameworks for taking a startup from a bright idea to a world-changing business. I found myself inspired reading their stories, and I hope their journeys may motivate other agency owners as well.

Key Milestones of Top SaaS Companies

| Company | Founded | IPO Year | Current Market Cap |

|---|---|---|---|

| Salesforce | 1999 | 2004 | $208B |

| Slack | 2009 | 2019 | Acquired for $28B |

| Zoom | 2011 | 2019 | $36B |

| Shopify | 2006 | 2015 | $85B |

| Datadog | 2010 | 2019 | $38B |

Salesforce

Back in the 1990s, most enterprise software was sold via expensive licenses and installed on-premise. Salesforce changed the game by delivering customer relationship management (CRM) software over the internet via a simple subscription.

Rather than focusing on feature checklists, Salesforce made the software easy to use. The company also allowed customers to start small and scale up as adoption grew within their organizations.

This frictionless onboarding model allowed Salesforce to find product-market much faster than legacy software vendors. The company's recurring subscription revenue then enabled it to invest aggressively in new products, accelerating its growth even further.

Here are some key stats on Salesforce's success:

- $26.5 billion revenue in FY22, up 25% YoY

- Over 150,000 customers

- $208 billion market cap, making it one of the most valuable SaaS companies

Slack

In 2013, most professionals communicated at work via email. Slack changed that by creating a user-friendly platform for teams to collaborate.

The company focused relentlessly on building a superior product to traditional enterprise collaboration tools. Slack integrated neatly with hundreds of other apps, enabling seamless workflows.

Slack also prophetically leveraged a freemium business model. Anyone could sign up and use basic features for free. Once teams got hooked, Slack then monetized them with premium subscriptions.

This playbook has worked brilliantly:

- Over 169,000 paying customers

- Grew revenue by 43% YoY in FY20 before being acquired by Salesforce for $28 billion

- Still growing over 30% YoY as part of Salesforce

Revenue Retention Rates

| Company | Net Revenue Retention |

|---|---|

| Salesforce | ~125% |

| Slack | 130%+ |

| Zoom | 130%+ |

| Shopify | No data available |

| Datadog | 130%+ |

Best-in-class net revenue retention rates of these companies. Over 130% means existing customers are spending 30%+ more each year.

Zoom

When Zoom launched in 2011, legacy video conferencing software was extremely complex and expensive. Zoom made video meetings simple, reliable, and free for basic use cases.

The company's maniacal focus on ease-of-use quickly led to viral growth. When the pandemic hit in 2020, Zoom was perfectly positioned to become the video platform for the world.

Zoom's freemium model accelerated this growth tremendously. Here are some of the key numbers:

- $4.1 billion revenue in FY22, up 55% YoY

- Over 504,000 customers with more than 10 employees

- $36 billion market cap

Shopify

A decade ago, Shopify made it easy for anyone to set up an ecommerce store and start selling online. Legacy solutions were either overly complex enterprise platforms or simplistic DIY websites.

Shopify struck the perfect balance with an easy-to-use SaaS solution. It enabled entrepreneurs to get started quickly while also providing room to scale.

The company grew exponentially along with the rise of direct-to-consumer online brands. It now powers over 1 million merchants globally:

- $4.6 billion revenue in 2021, up 57% YoY

- $85 billion market cap

- Still growing over 50% YoY

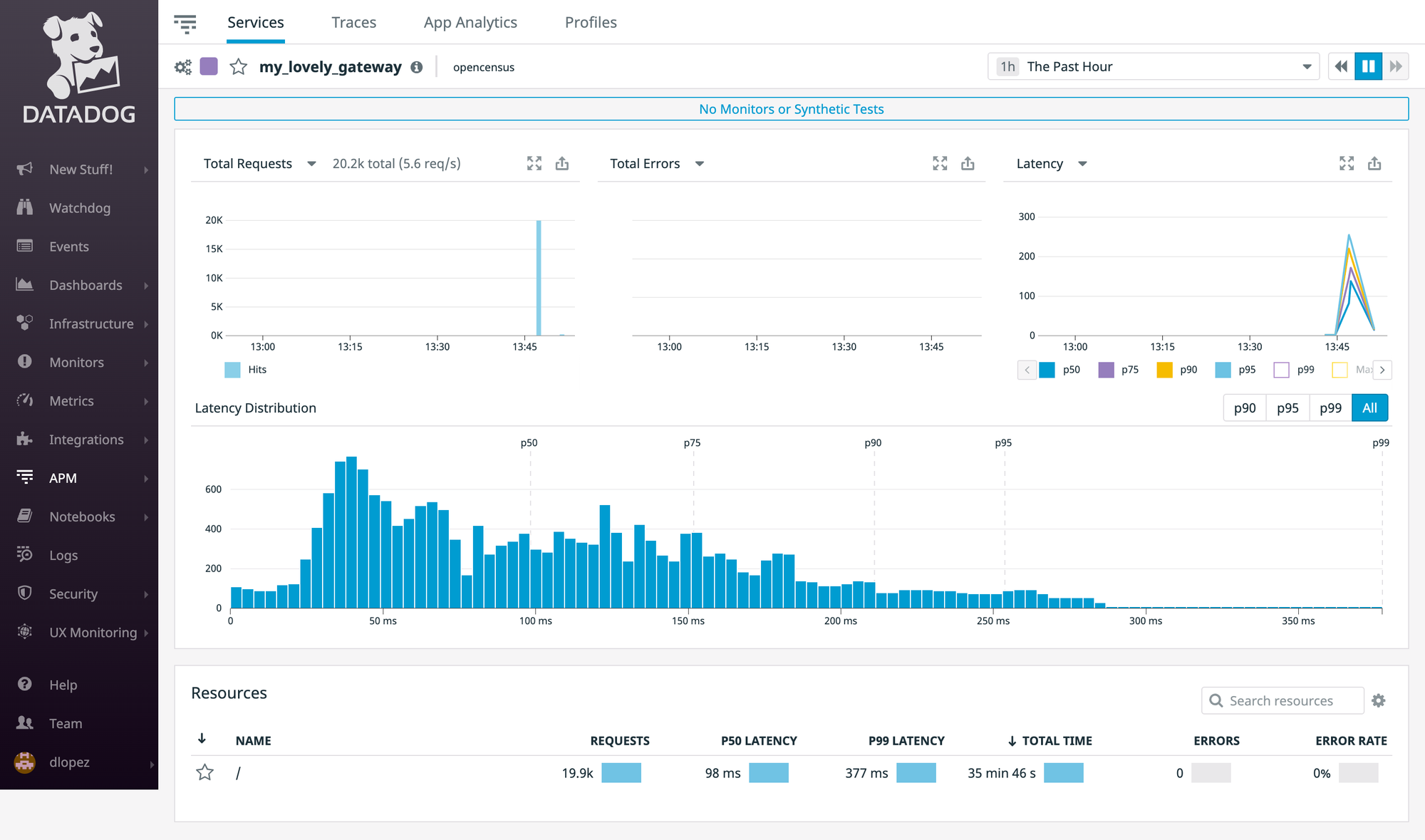

Datadog

Datadog is a more recent SaaS success story. In the 2010s, companies struggled with piecing together disparate monitoring and analytics tools for their infrastructure and apps.

Datadog unified all of this into a centralized platform with a simple UI. The company also priced based on value delivered rather than convoluted host-based pricing models.

Here are some metrics that highlight Datadog's explosive growth:

- $1.0 billion revenue in 2021, up 70% YoY

- 15,000+ customers including 40% of the Fortune 100

- $38 billion market cap

- Still growing over 50% YoY

The SaaS business model has fueled incredible amounts of innovation and growth over the past 20 years. However, the core principles of solving real customer pain points, delivering 10x value over the status quo, and leveraging scalable go-to-market models haven't changed.

These case studies showcase companies that successfully executed this playbook and built multi-billion dollar businesses as a result. As we look towards the next wave of SaaS companies, studying these success stories provides a blueprint for how to navigate exponential growth in new markets.

FAQ

What are the key benefits of the SaaS business model?

The SaaS or software-as-a-service model provides many benefits over traditional on-premise software:

Recurring revenue - SaaS companies earn recurring monthly or annual subscription fees, providing very predictable revenue streams.

Scalability - SaaS software can scale to serve thousands of customers without significant incremental costs. This enables tremendous operating leverage.

Fast iteration - SaaS companies can rapidly roll out new features and updates to all customers at once in the cloud. This accelerates product innovation.

Customer engagement - With all users on the latest version, SaaS companies have much more customer usage data to analyze and engage with.

Lower entry costs - The pay-as-you-go model lowers barriers to adoption compared to large upfront licenses. Customers can start small and scale up.

What are some key strategies SaaS companies use to drive growth?

Leading SaaS companies use various strategies to drive strong growth:

Viral onboarding - Generous and customizable free plans, frictionless signup, and easy integrability with other tools help drive viral adoption.

Land and expand - Onboarding teams at low initial price points and usage levels, then expanding within organizations from there.

Usage based pricing - Charging based on value delivered and number of users encourages customer expansion over time.

Obsessive CX focus - Maniacal focus on customer experience across the onboarding journey, product experience, and customer support drives renewals and referrals.

Targeted upsells - Advanced capabilities, increased usage tiers, and add-ons provide upsell opportunities.

How important is product-market fit for SaaS companies?

Product-market fit is the lifeblood of any successful SaaS company. SaaS businesses live and die based on their ability to get customers to use and stick with their products.

Without great product-market fit, SaaS companies will struggle to convert and retain customers. Engineers will also burn out building features no one wants. Achieving great product-market fit is exceedingly difficult, but 100% necessary to build a great SaaS business.

What steps can SaaS companies take to improve product-market fit?

Some best practices include:

Release an MVP quickly and start getting user feedback immediately. Don't wait to launch the "perfect" v1 product.

Analyze usage data frequently. Look for features with low adoption and double down on highly used capabilities.

Survey users constantly. Dig into reasons for churn.

Obsess over customer support tickets and forums. Many product insights live here.

Watch user videos and over-the-shoulder usage to understand pain points.

Clearly define target users and their workflows. Build for specialized use cases vs. broad appeal.

Talk to users and prospects constantly.

How important are freemium models for SaaS startups?

Freemium models have proven immensely successful for many leading SaaS companies like Slack, Zoom, and Datadog. However, freemium by itself is not a silver bullet.

The keys to making freemium work are:

Providing tremendous value in the free version. Don't make it feel like a crippled trial.

Defining a clear pathway from free to paid. Make it obvious what value paid plans provide over free.

Setting pricing and features such that the majority of serious users will need to upgrade to paid.

Making the upgrade process extremely frictionless.

Freemium done right aligns user needs with the company's monetization strategy.

What are the most important SaaS metrics to track?

Critical SaaS metrics include:

MRR - Monthly recurring revenue. The most important leading indicator of business health.

Churn - Customer attrition rate. Must be measured and monitored closely.

CAC - Customer acquisition cost. What it costs to acquire each new customer.

LTV - Lifetime value of a customer. The metric CAC should be measured against.

MRR growth - Month-over-month MRR increase. Key growth metric.

Net revenue retention - Increase in spend from existing customers. Over 100% is best practice.

Gross margin - Revenue remaining after COGS. Keep an eye on gross margin trends.

What are the keys to reducing churn for SaaS companies?

Winning SaaS companies obsess over churn reduction:

Ensure product-market fit - Nothing matters more than this.

Provide an excellent onboarding experience - Set up users for ongoing success.

Ongoing education/training - Keep users engaged and proficient.

Customer success teams - Proactively monitor and help customers.

Usage tracking - Analyze usage data to predict churn risk.

Churn analysis - Dig into reasons for every churn to find patterns.

Upsells - Expand revenue from existing customers to improve retention.

How do the most successful SaaS companies scale their sales and marketing?

SaaS sales and marketing relies heavily on leverage:

Leverage self-service - Drive as much inbound lead generation as possible through your website, free trials, seminars etc.

Invest in sales development - Build a strong SDR team to qualify inbound leads.

Hire account executives - AE's focus on complex, high-touch enterprise sales.

Leverage customer success - Upsell accounts through CSM's.

Double down on what works - Scale your best performing sales and marketing channels.

What are the biggest pitfalls for early stage SaaS companies?

Some common missteps of SaaS startups include:

No product-market fit - Chasing too many use cases or customers that don't experience enough pain.

Lack of focus - Trying to be all things to all people leads to mediocrity.

Overbuilding features - Rather than iterate based on user feedback.

Ignoring churn - Lack of rigor in churn analysis and reduction.

Overspending early - Prematurely scaling go-to-market before finding fit.

Not tracking right metrics - Vanity metrics vs. actionable metrics like churn.

Not raising enough capital - SaaS takes time and capital. Underfunding can be fatal.