I know what you're thinking: “Oh great, another blog post preaching the gospel of user retention.” But hear me out. After years in the marketing trenches, leading campaigns for brands across industries, I've come to a startling realization: the loyalty obsession is holding us back.

Don't get me wrong, I'm not saying retention isn't necessary. Of course, we all want customers who stick around, sing our praises, and keep the revenue engine humming. But in the mad dash to minimize churn, many companies are missing the bigger growth opportunity right in front of them: acquiring the right customers in the first place.

Unpacking the Retention Assumption

The idea that retention trumps acquisition has become a marketing maxim. The logic seems sound: keeping a customer you already have is easier than convincing a new one. A frequently-cited study by Bain & Company claimed that increasing retention rates by 5% boosts profits by 25% to 95%.

But these assumptions start to break down under scrutiny:

The cost difference between retention and acquisition varies wildly across industries and customer segments. In some cases, re-activating lapsed users or upselling existing accounts is more expensive than bringing in new blood.

Retention rate is not synonymous with profitability. Loyal customers may demand steeper discounts and more service, eroding margins over time.

Treating all retained customers as equally valuable ignores differences in purchasing power, advocacy impact, and growth potential. Not all loyalty is created equal.

The ROI of Acquisition

To truly maximize ROI, we need a more nuanced framework for weighing retention against acquisition. This means looking at factors like:

Customer Lifecycle: In categories with short-term relationships (e.g., wedding services, student housing), aggressive new customer acquisition is the only path to growth.

Margin Structure: Business models with high fixed costs and low variable costs (e.g., SaaS) can thrive on volume even with higher churn, as long as unit economics remain positive.

Market Maturity: In a competitive, saturated market, there may be little headroom to improve retention. The upside is in stealing share from rivals.

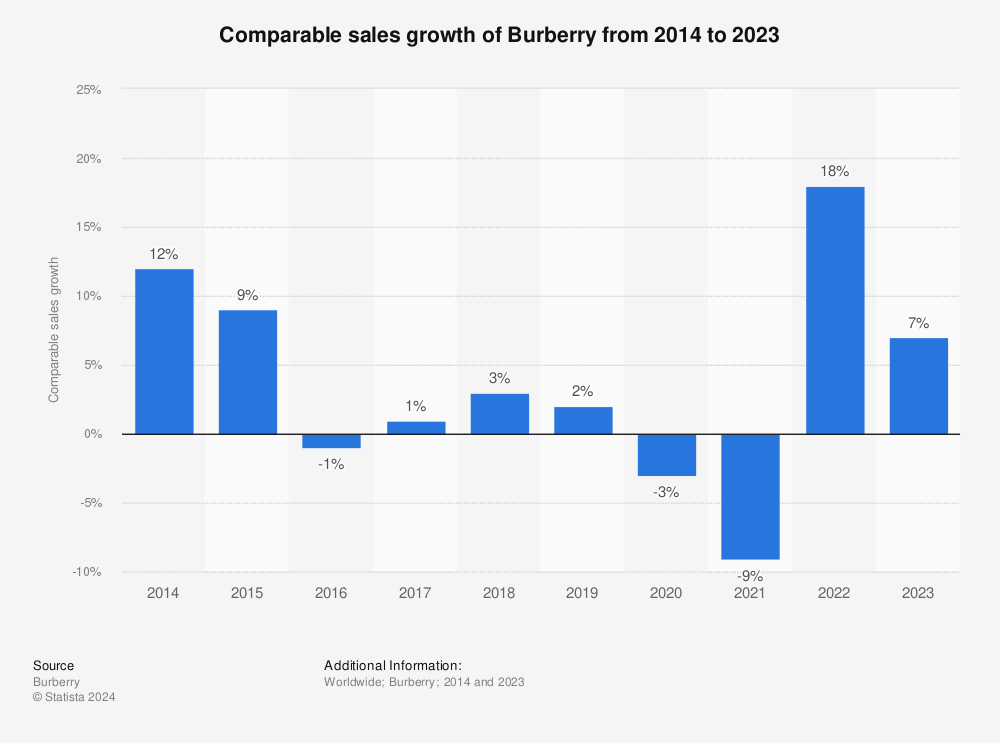

Consider luxury fashion brand Burberry. Facing stagnating sales and brand dilution, they pivoted hard from a mass-market position to a prestige one. They reduced their active customer base but dramatically increased average order value and profitability by acquiring a new high-end clientele.

| Metric | Before Pivot | After Pivot |

|---|---|---|

| Active Customers | 1,000,000 | 500,000 |

| Average Order Value | $500 | $1,500 |

| Gross Margin | 50% | 70% |

| Annual Revenue | $500M | $750M |

Unit Economics and Churn Tolerance

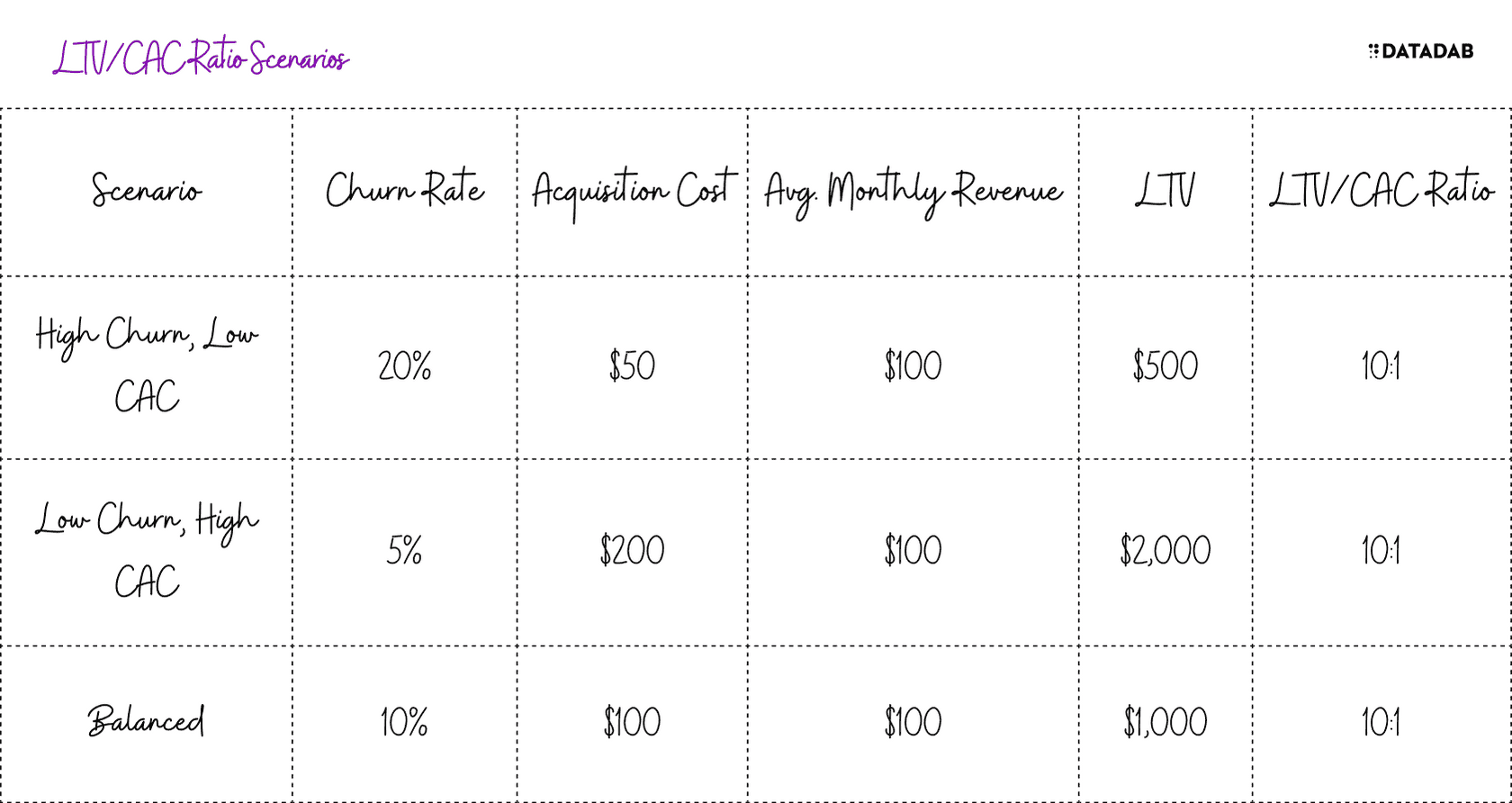

Many marketing teams are laser-focused on reducing churn rate, often at the expense of growth-driving acquisition efforts. But churn isn't inherently bad if your unit economics are strong.

Imagine two competing subscription services:

| Metric | Company A | Company B |

|---|---|---|

| Avg. Customer Lifetime | 12 months | 6 months |

| Churn Rate | 8% | 16% |

| Customer Acquisition Cost | $100 | $50 |

| Avg. Monthly Revenue/User | $50 | $50 |

| Lifetime Value (LTV) | $600 | $300 |

| LTV/CAC Ratio | 6:1 | 6:1 |

Company B has double the churn of Company A, but also half the cost to acquire a customer. The net result is identical LTV/CAC ratios - both have a healthy, profitable business. Company B can grow twice as fast at the same margin.

Look at another scenario down here. Sometimes, numbers do not really paint a complete picture:

Market Share and Mindshare

Retention is critical for cash flow and profitability. But in many industries, the long game is about dominating the market. Companies need a large, engaged user base to build strong network effects, robust data models, and durable brand equity.

Take ridesharing: Uber and Lyft are locked in a bitter battle for market share, with both spending aggressively on rider and driver acquisition. Customer loyalty is fickle in a commodity market; most people simply choose the app with the shortest wait time. The winners will be those who achieve the liquidity and scale to deliver the best experience.

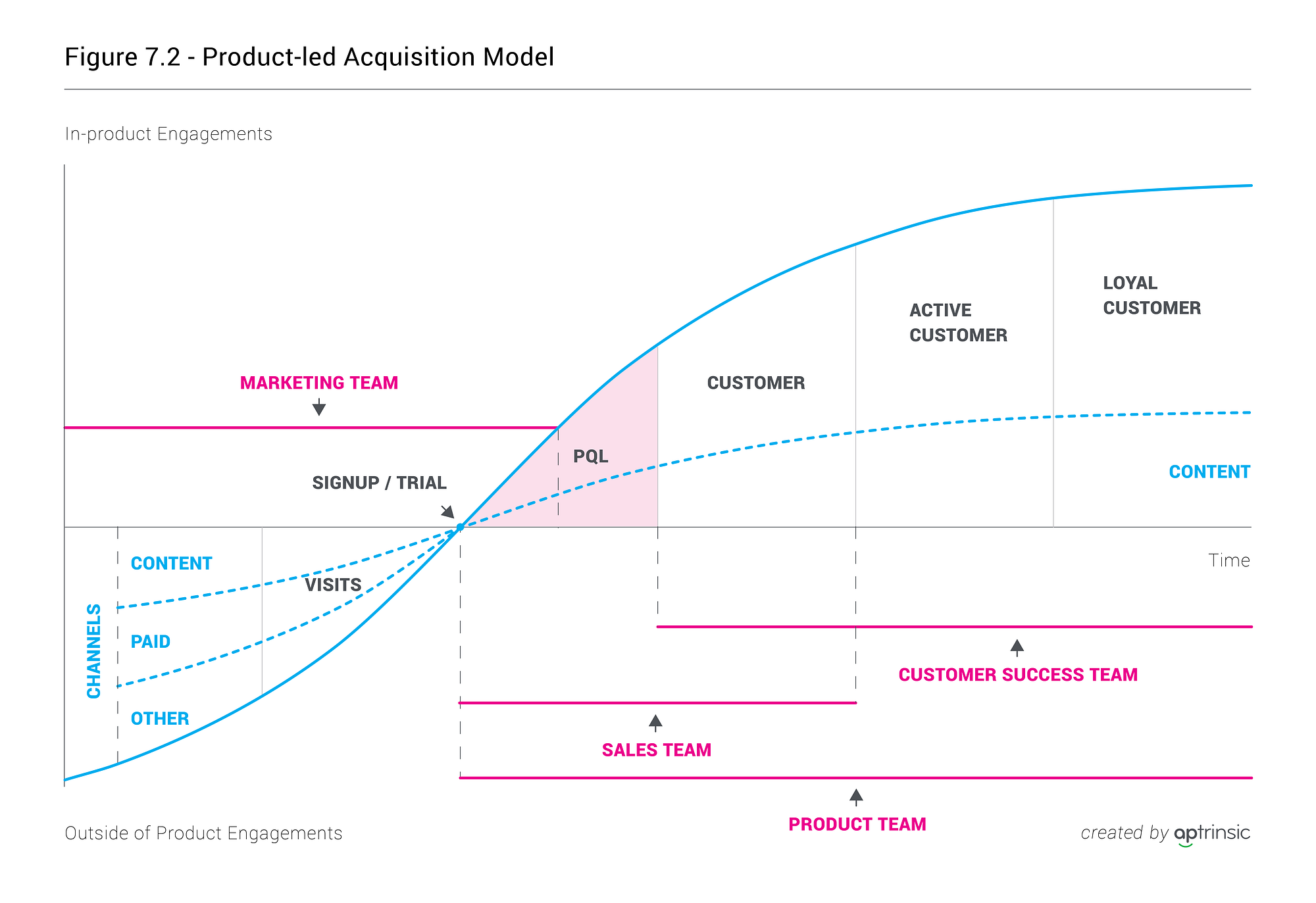

The Lifecycle Lens

The optimal balance of retention and acquisition efforts evolves as a company matures:

Startup

Retention is a vital proof point for product-market fit and capital efficiency. But premature retention focus risks starving growth.

Growth

Aggressive acquisition takes priority to achieve escape velocity and secure market share. Network effects and economies of scale begin to kick in.

Maturity

With a dominant position established, focus shifts to maximizing profitability and defending share through deeper customer relationships. Retention becomes the priority.

| Stage | Acquisition Priority | Retention Priority |

|---|---|---|

| Startup | Medium | High |

| Growth | High | Medium |

| Maturity | Medium | High |

The key is to sequence these strategies in line with your business stage and goals.

Optimizing Acquisition Performance

High-yield customer acquisition is both art and science. Some proven tactics:

- Micro-segmenting audiences by predicted customer lifetime value to prioritize highest-potential targets

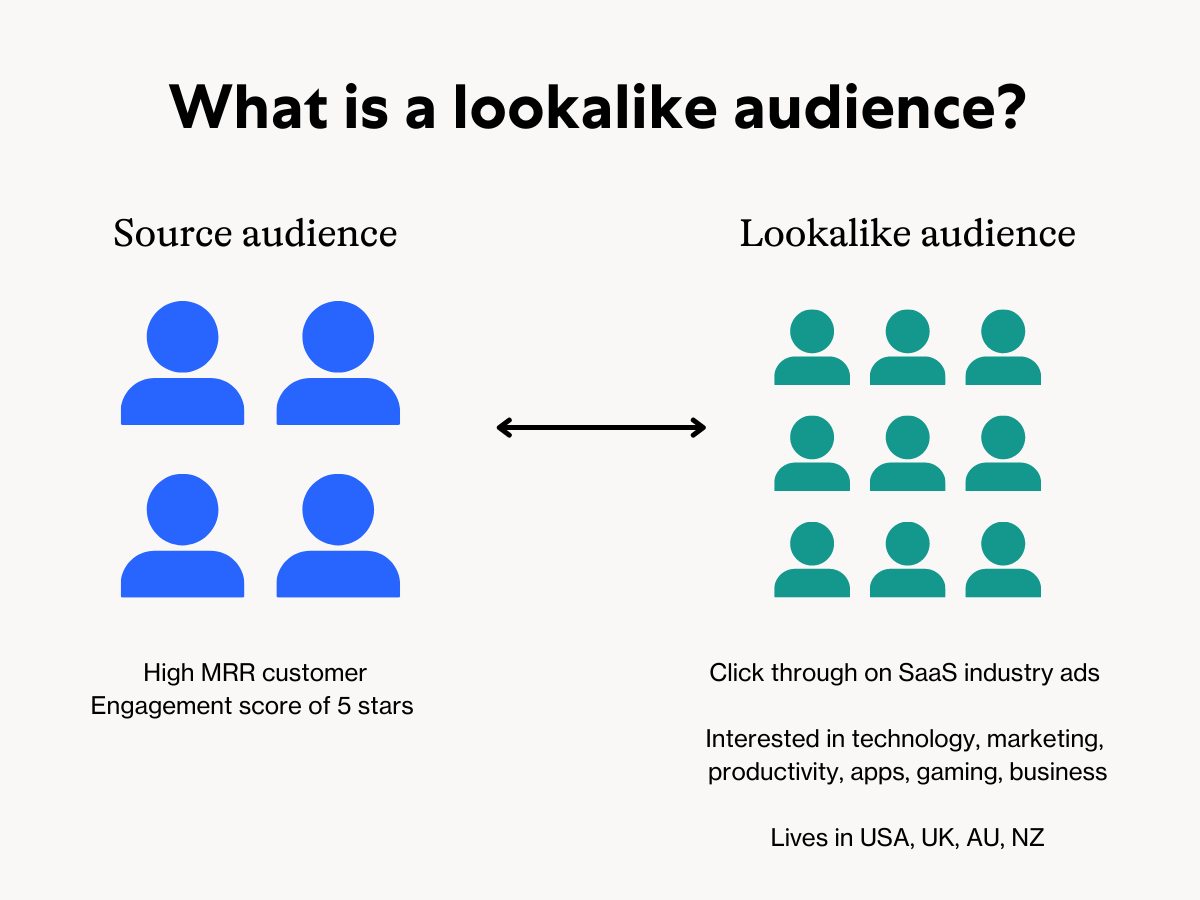

- Personalizing acquisition offers and onboarding flows based on user signals and lookalike profiles

- Leveraging emerging channels and media models to efficiently reach valuable new audiences ahead of competitors

- Continuous creative and copy testing to zero in on high-converting, on-brand messaging

At our agency, we've deployed acquisition-led growth strategies to help clients outpace their industries by 3-5x. The key is a relentless focus on the unit economics of each campaign and customer cohort.

The Risks of Retention Obsession

Becoming too retention-obsessed can be risky:

Stagnation: If you're not continuously bringing in new blood, your customer base can skew stale and revenue can plateau.

Margin Compression: Over-delivering to retain risky customers can erode profitability. Every so often, it's better to let them churn.

Competitive Vulnerability: Focusing solely on current customers leaves you exposed to competitors poaching your best ones and cornering new market segments.

| Churn Reason | % of Churned Customers | Avg. Lifetime Value | Retention Strategy |

|---|---|---|---|

| Price | 30% | $500 | Offer personalized discounts |

| Product Issues | 25% | $750 | Prioritize feature requests |

| Poor Service | 20% | $1,000 | Improve support quality |

| Competitor Switching | 15% | $1,500 | Enhance differentiation |

| Other | 10% | $1,000 | Conduct exit surveys |

Retention is essential, but it can't come at the expense of finding tomorrow's most valuable customers.

Rethinking Loyalty

It's time to move beyond the retention-first dogma. Yes, keeping customers is important. But in many scenarios, the smart money is on identifying, acquiring, and growing your highest-value buyers - even if it means accepting more churn along the way.

Don't just take it from me. Look at your data. Map your acquisition and retention efforts to revenue and profitability. Run the unit economic scenarios unique to your model. The loyalty myth may be holding back your growth.

Let's talk about building a breakout acquisition engine for your business. Our agency has done it for leading brands across industries. Now, it's your turn.